Special Situations

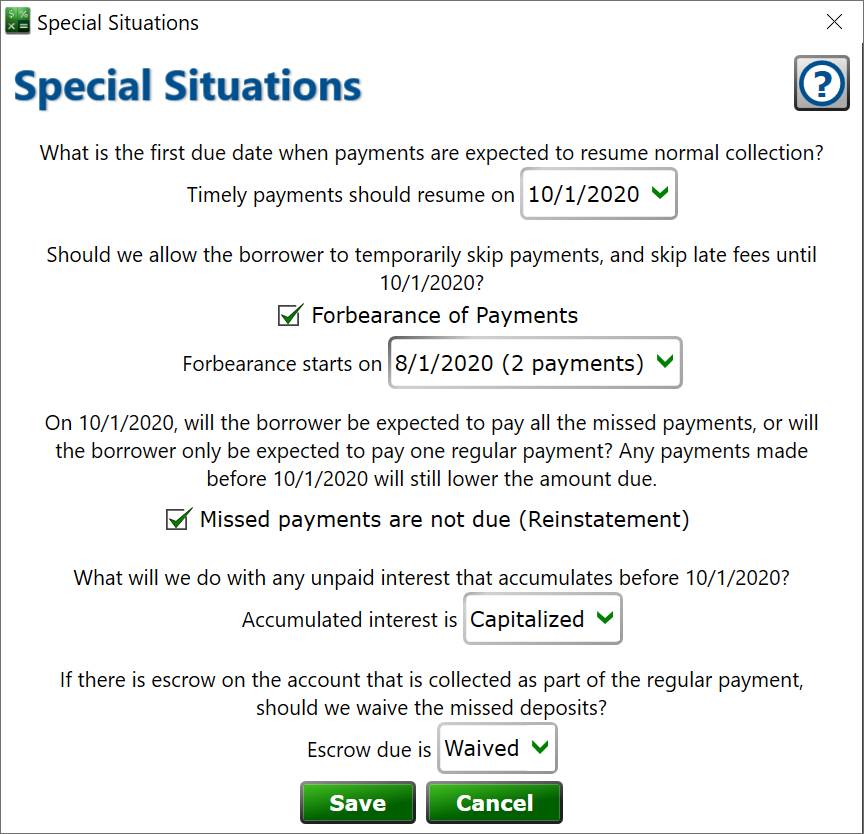

Find this window by selecting a loan > Settings tab > scroll to the bottom to find the Special Situations section > click New or select and existing setting and click Edit.

Under certain circumstances you may wish to allow the borrower to skip one or more payments in a row. This is often done for hardships such as loss of employment of medical necessity. Some laws arising from the COVID-19 pandemic require lenders to offer forbearance plans to their borrowers.

Use the Special Situations setting to add a period of forbearance to a loan.

Timely payments should resume on – choose the first due date where the borrower will be expected to start sending in payments again.

Forbearance of Payments – check the box to indicate that payment will be skipped for one or more due dates.

Forbearance starts on – choose the starting due date of the forbearance. That payment, and any due dates thereafter, will not need to be paid until the date chosen for timely payments resume above.

Missed payments are not due (Reinstatement) – check this box and on the timely payments resume date, only the regular payment and escrow will be due on the loan. If the box is not checked, all regular payments and scheduled escrow deposits that had accrued will become due and payable on the timely payments resume date.

Accumulated interest is – How should Moneylender handle the accumulated interest?

- Unaffected – the interest has accumulated on the loan and will need to be paid down before payments will start to pay down the principal balance again.

- Capitalized – the interest is added to the principal balance and begins to accrue interest itself. On the Payment Distribution report, you’re likely to see payments paying down interest and principal, which may make the borrower feel satisfied, but this option actually results in more interest profit for the lender.

- Waived – the interest that accrued prior to the timely payments resume date will be erased from the loan and never collected. This essentially means the special situation represents a period where there will be no interest on the loan. If there was unpaid interest prior to the start of forbearance, this interest is also waived.

Escrow due is – what do we do about the schedule escrow deposits that occurred alongside the regular payments due during the deferment period?

- Unaffected – leave the accumulated Escrow Due alone. When payments resume, they will first be deposited into the escrow account until the amount that should have been collected has been applied, and then the payments will pay interest and fees.

- Waived – The accumulated escrow deposits are not collected. Only the regular escrow deposit on the timely payments resume date will be put into the escrow account. There may be an escrow shortfall as a result. Moneylender’s escrow charge calculator can address the shortfall when you perform your next escrow analysis on the loan.