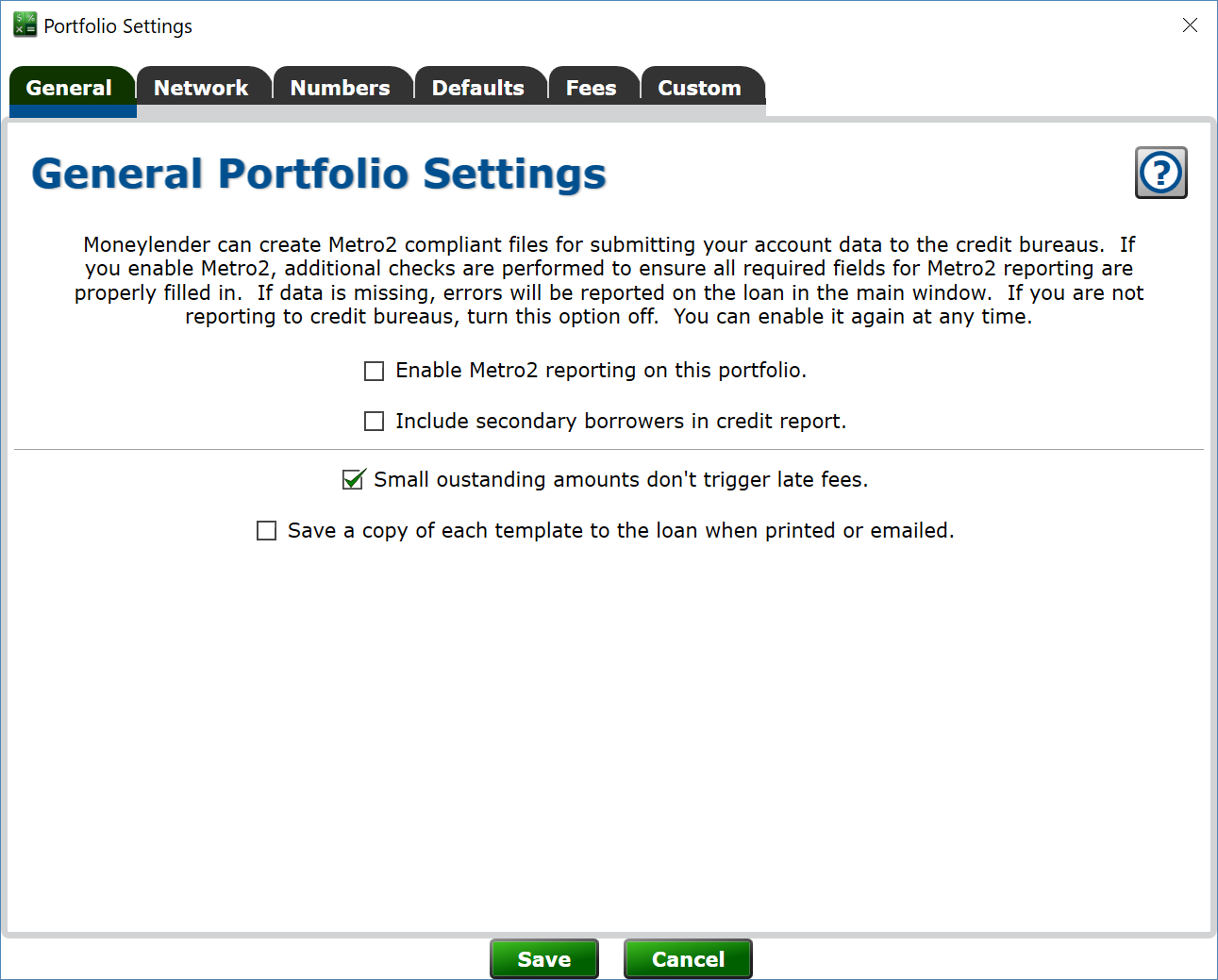

General Portfolio Settings

Moneylender can produce Metro2 formatted files. If you have a data submission agreement with Innovis, Equifax, Experian or TransUnion you can submit these files to them to report your borrowers' performance on their loans.

Metro2 requires several specific fields to be correctly set on loans, borrowers and lenders to produce a valid Metro2 credit report. This is turned off by default because many users will not need to enter all these details. Check the box to enable Metro2. A series of checks are run when loans are recalculated to determine if any required metro 2 data is missing from a loan or borrower. If it is, you will see the warning icon next to a loan turn red, and you can see the details of the missing information from the warning icon.

Check the box to include secondary borrowers on the report if that is your preference. All non-primary borrowers will also be included in the report when this box is checked.

Small outstanding amounts don't trigger late fees. Check this box an Moneylender will skip late fees if the amount due after the grace period is less than one fourth of the regular payment amount on the loan. For example, if a borrower is scheduled to pay 1080.37 each month, and pays $1080. The remaining $0.37 won't trigger a late fee. If they pay $1000, it still won't trigger a late fee. If they pay $500, it will trigger a late fee. If the box is not checked, even the $0.37 underpayment will trigger a late fee.

Save a copy of each template to the loan when printed or emailed. Check this box, and a PDF copy of any template sent to the borrower will be attached to the loan. Select the loan and click the Attachments tab to see the statements. This can cause your portfolio to become quite large as statements can each be 10kb or larger. 100 loans with monthly statements for a year can easily add 21MB of attachments to the portfolio. The portfolios performance won't be adversely affected, but the additional size is something to be aware of.