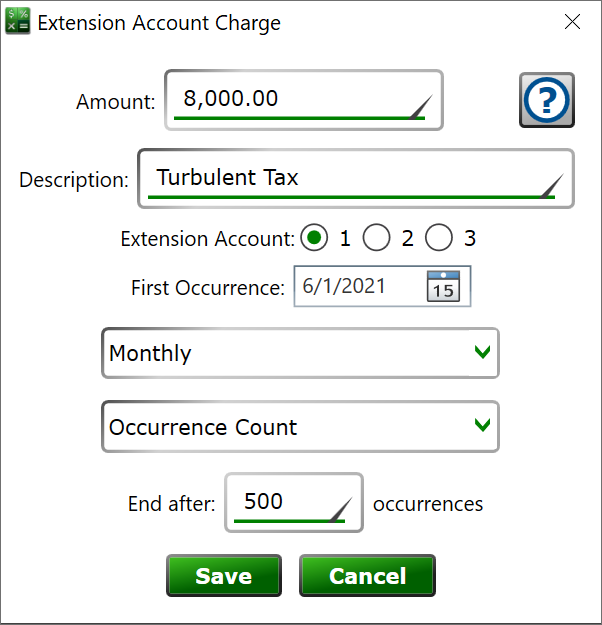

Extension Account Charge

Find this window by editing or creating a record in the Extension Accounts at the bottom of the Settings tab of Moneylender's main window.

Extension Accounts allow a deeper itemization of fees and other charges on a loan. If you have a need to separate certain fees from the rest of the normal loan fees, use one of the three extension accounts to do it. Individual payments will track how much of their funds are used to pay each of the extension accounts, allowing you to get per-payment numbers for the amounts paid into each extension account.

The charge records work very similar to the Other Fees records on the loan. You can have one-time and recurring charges on an extension account. You can see the transactions for each of the extension accounts from the Ledger Transactions report by choosing an extension account from the drop-down at the top-left. You can add the extension account amounts to reports like Payment Distribution and Payment Reconciliation, as well.

Charges to an extension account are due, collectible and included in the total amount due on a loan.

Amount - the amount of the charge to add to the extension account.

Description - an indicator of the reason or label for the charge.

Extension Account - choose which of the three accounts this charge belongs in. You might use account 1 for sales tax on your loans and account 2 for currency exchange fees on your loans, for example.

First Occurrence - the date of the one-time fee, or the start of the recurring cycle of fees to add to the loan.

Schedule Type - choose if the fee is once, or on a recurring basis.

End Type - should the recurrence run forever, end after a set number of charges, or end on or before a specific date.

End after - the number of charges to add to the loan

End on or before - the date that marks the end of the recurring charges.

Added in v3.0.186