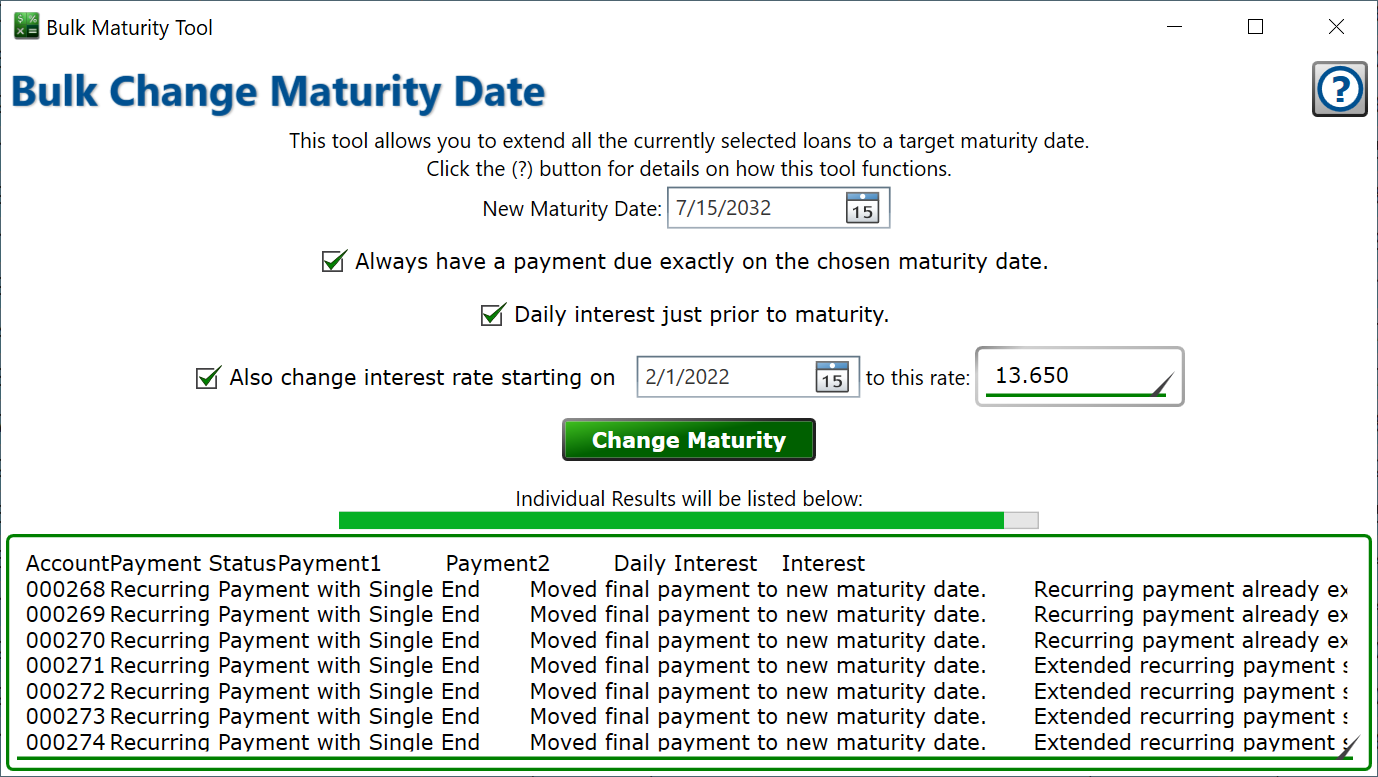

Bulk Change Maturity Date Tool

This tool allows you to extend all the currently selected loans to a target maturity date.

Get here by clicking Tools > Bulk Maturity Date Change.

New Maturity Date – Enter the new date when the selected loans will reach maturity and become payable in full.

Always have payment due exactly on the chosen maturity date – check this box and a single payment with the schedule type “Once” will be added on exactly the maturity date if that date is not already on the current payment schedule. Moneylender will check if there is an existing final payment on its own at the end of the loan, and just move that payment rather than create a new one. The amount of this single payment will be set to 1.00 since the final payment on a loan is always the amount needed to pay the balance in full.

Daily interest just prior to maturity – if interest is on its own schedule, checking this box will create a daily interest setting from the end of the last full interest cycle up to the new maturity date. If there is an existing daily interest setting on the loan after a non-daily recurring interest schedule, the existing setting is moved rather than creating a new setting.

Also change interest rate starting on … to this rate – When checked, Moneylender will check for a rate that already begins on the specified date and change its rate if found. If not found it will create a new rate on the specified date matching the schedule settings of the rate immediately prior to the starting date (or monthly if no rate setting exists at that point in time) and then change all subsequent rate settings to the specified rate.

– once you have set your selection in the window, click this button to begin the process. You will be asked if you are sure you want to proceed.

The progress bar will advance as the process completes each loan. When the results appear in the textbox at the bottom of the window the process is complete.

The results box will contain a tab-separated list of the status of each loan as well as the actions performed on the payment and interest rate records for the loan. It can be copied and pasted into a spreadsheet for easy review.

When extending a loan, this is the logic that the tool will follow to adjust the payment settings:

- If the loan already has at least one payment after the new maturity date, nothing is modified on that loan. This tool will only extend loans, never shorten them.

- If the loan has no payment settings at all, a single payment set to the “Once” is added to the loan on the target maturity date.

- If the loan has only one payment setting and that setting is “Once”, the date of that payment is moved to the new maturity date so that the loan’s single payment is due on the new maturity date.

- If the loan ends with a “Once” setting, and has a “Once” setting preceding it, then a new “Once” setting is added at the maturity date.

- If the loan ends with a “Once” setting, and has anything except a “Once” setting preceding it, then the final payment setting is moved to the new maturity date and the previous setting is extended to the new maturity date if needed.

- If the loan’s last (or single) payment setting is anything except “Once”, the schedule is extended to the new maturity date. If the option to always end exactly on the new maturity date is checked and the schedule doesn’t land exactly on the maturity date, a “Once” payment is added for the exact maturity date.