Printing onto Official IRS Forms

1098 Walkthrough Video

1098 Walkthrough Video

You can get here by clicking Regional > United States > Form 1098 – Mortgage Interest Statement from the main menu.

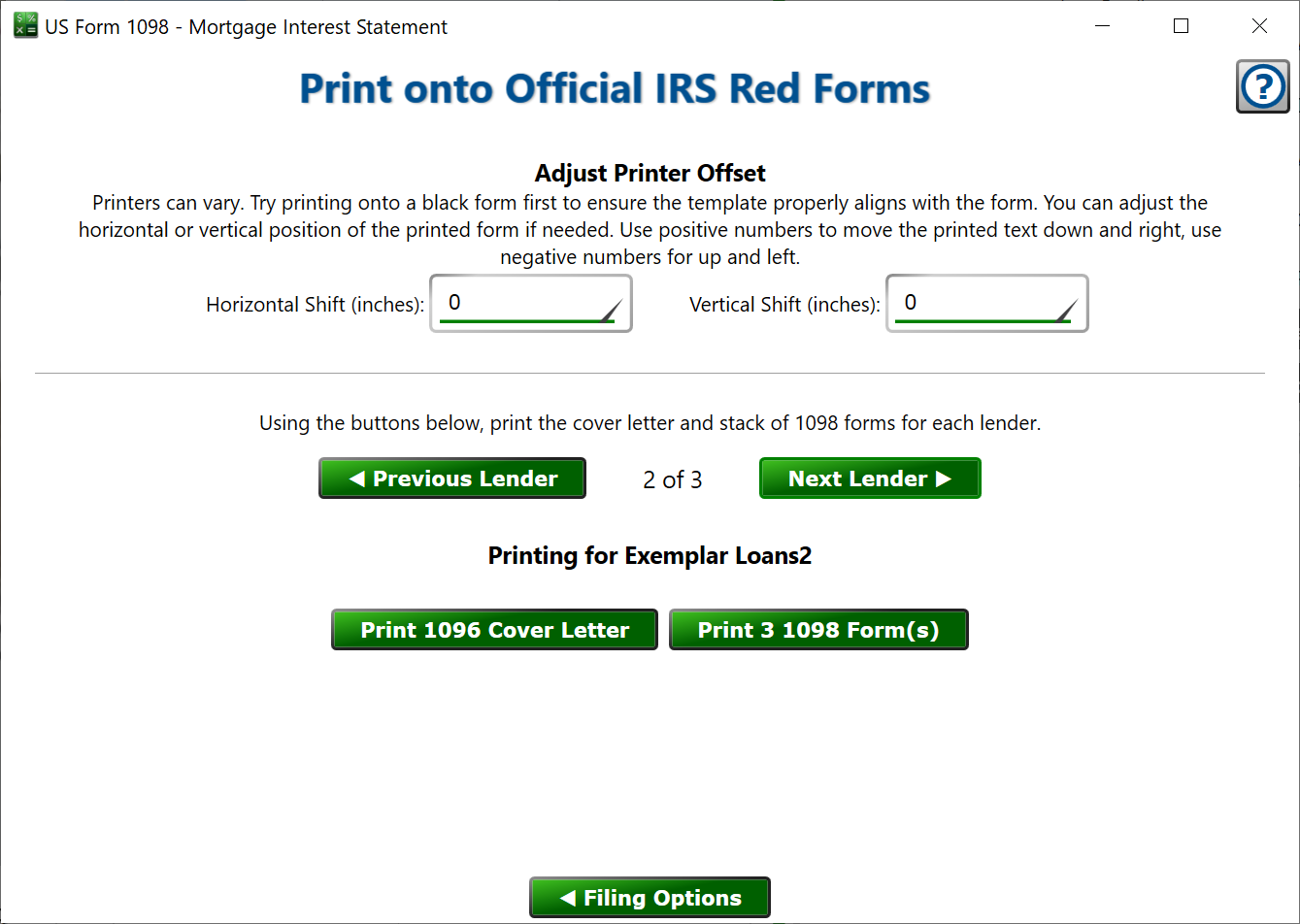

Align the printed template before using the red copies!

Print a 1098 or 1096 onto one of the black copies of the official forms first, to ensure the information is positioned in the right boxes.

If the information is not well aligned, adjust the position by entering a horizontal and/or vertical shift in the boxes provided and try again.

Horizontal Shift – a positive amount will move the template to the right, a negative amount will move it to the left. For example, enter -0.25 to move the printed data left by 1/4 of an inch.

Vertical Shift – a positive number will move the template down, negative moves the template up. For example, 0.1 will move the data down the page by 1/10 of an inch.

Printing the Forms

You’ll print stacks of returns for each lender. Each stack must have a 1096 form on top, and be followed by that lender’s 1098 forms. Start with the first lender and print the 1096 cover letter followed by the specified number of 1098 forms. 1098s are two-per-page, so you’ll need half as many forms (round up to the next whole number) as the number shown on the button.

– set the lender to print to the previous lender.

– advance to the subsequent lender to print their stack of forms.

– put a single 1096 sheet into your printer, and then print the lender’s 1096 form. The print template window will list the first loan in that lender’s stack, which is normal. No loan or borrower specific information is present on the actual template so the template prints only the lender information and the sum of the 1098 amounts for that lender.

– Prints the current lender’s stack of 1098 forms. Put blank IRS 1098 forms in your printer, and then print that stack. Be sure to put this lender’s 1096 form on top of the stack of their 1098s.

– return to the previous page if you want to file your 1098s electronically instead.

When you’ve printed all your 1096s and 1098s, you can close this window. Put those returns in the mail and you’re all done until next year. Congratulations!

See also:

Preparation

Borrower Selection

Correction

Printing for Borrowers

IRS Filing Options

We eFile Your Returns

You eFile Your Returns

You Print Your Returns