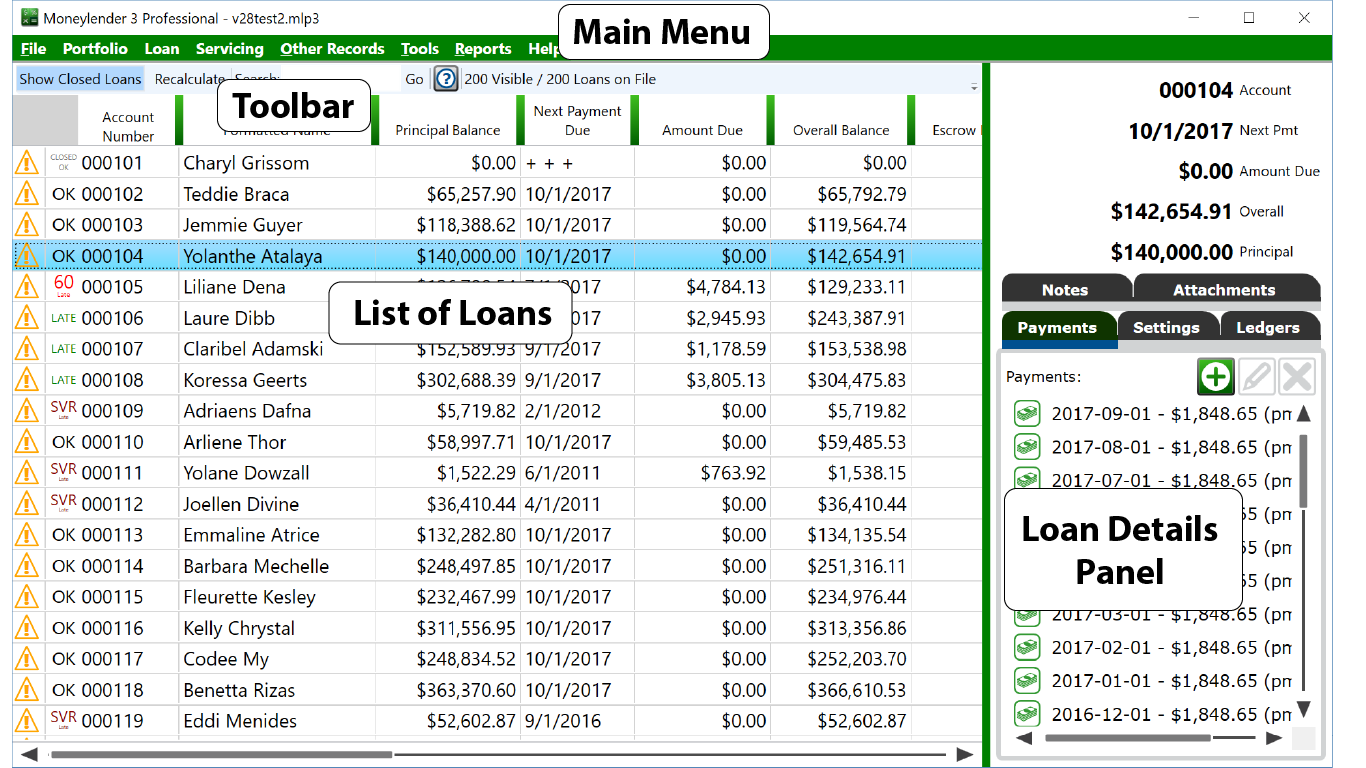

Moneylender's Main Window

The Main Window is divided into four components:

- The Main Menu

- The Toolbar

- The List of Loans

- The Loan Details Panel

- Keyboard Shortcuts

Use the menu for actions that have big effects like choosing the portfolio file to work with, printing statements, setting the program-wide and portfolio-wide settings, running reports, and other management-oriented actions.

Servicing options all greyed out? Click any loan in the list first. Some of the template printing options require at least one selected loan.

Main Menu Items

Details about items on the main menu and what they do.

Loan Menu

Skip One Payment and Exend Loan - When you want to let the borrower skip the next due date on the loan (the first unpaid due date on the loan) and extend the loan by one payment. Interest is waived for that skipped payment and recurring fees are adjusted off, meaning the cost of the loan for the borrower does not increase even though it will take one additional cycle to repay. This will create a series of records to modify the structure of the loan. A Special Situation will defer the due date, reinstate the loan, and waive the interest. The last payment schedule will have the occurrence count increased by one. Any recurring fees that coincide with the skipped date will be extended by one and an adjustment is added to the loan to cancel the fee from the skipped date.

The Toolbar provides access to some features that make working with the loans easier. Showing or hiding closed loans, searching the list of loans.

The List of Loans displays all the loans in the portfolio (with closed loans hidden by default until shown using the toolbar). The columns on the list of loans can be set in the Moneylender Settings options. The size of the columns is preserved between sessions. Click a column to sort the loans by the selected column. Click again to reverse the sort order.

Selecting a single loan in the list of loans opens up most of the options in Moneylender. Selecting more than one loan opens up any options that are valid for multiple loans, such as printing statements for the selected loans or exporting those loans.

In date columns, you may see "- - -" to indicate "the beginning of time" and "+ + +" to indicate "the end of time". These two vallues are commonly used where an actual date is not valid. For example, an open loan will show "+ + +" in the Closed Date column. If the first due date on the loan is far in the future, you'll see "- - -" in the Current Due Date column.

The Loan Details Panel provides comprehensive access to the settings on the selected loan. You can review and manage the payments on the loan, all the settings from interest rates to escrow, review notes, and attach files. The details panel is where you go to manage everything relevant to the selected loan.

Keyboard Shortcuts for the Main Window

- Ctrl-S - put focus on the search box

- Ctrl-L - select the first loan in the list

- Ctrl-P - add a new payment to the selected loan

- Ctrl-D (when focus is on any date picker in Moneylender) - set the date in the box to Today