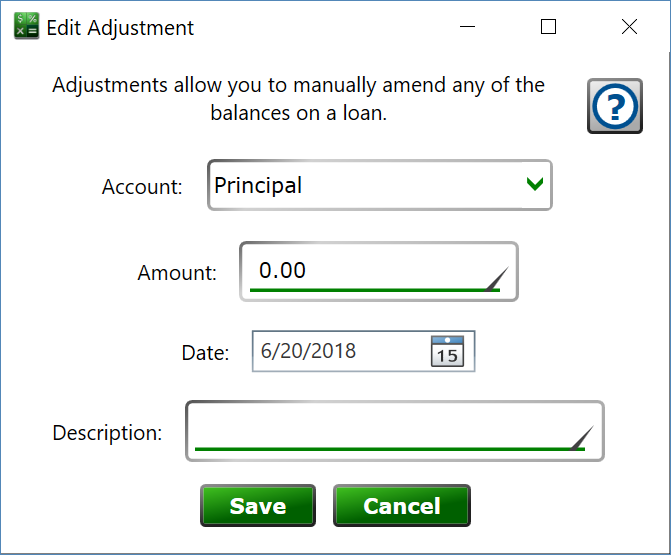

Edit Adjustment Dialog

From this window you can create and edit any manual adjustments you need to make to any of the balances on the loan. Each balance serves a unique purpose to the loan calculation engine, and adjustments are how you can tell the engine to modify certain numbers at various points in the life of the loan.

You can get here by clicking the New (plus) button on the Adjustment section of the Loan Details panel to the right of the main list of loans, or by selecting an existing adjustment from the list in that section and clicking the Edit (pencil) button.

Adjustments are applied after all the normal automation to a loan’s balances and prior to payments being applied for the day.

You can use the Ledger Transactions report that comes with Moneylender to see all the transactions on each of the accounts on a loan, and to see the balances of each account on various days over the life of the loan.

Account – choose the account whose balance you want to adjust.

- Principal – when adjusting principal, you are telling Moneylender to increase or take away principal from the loan. Do not use a principal adjustment to loan out more money on the same loan. Instead you should record a new Principal Disbursal record. Principal adjustments affect the balances of the Principal account, Interest Bearing account, and Ledger account.

- You might use a principal adjustment as part of a loan modification agreement where you agree to forgive some of the principal on a loan (entering the amount to forgive as a negative number).

- You might use a principal adjustment alongside and interest adjustment as part of a reinstatement agreement where you agree to consider the account current and capitalize the unpaid interest on the loan (adding a negative adjustment to the interest balance and a positive adjustment for the same amount to the principal balance to convert the interest balance into principal).

- Interest – adjusting interest allows you to add or remove interest from a loan. Adjustments to the interest account are applied to the loan’s Interest balance and the Ledger balance.

- You might use an interest adjustment if the per-diem interest calculated by Moneylender differs slightly from the amounts listed on your closing documents.

- You might use an interest adjustment to forgive outstanding interest as part of a loan reinstatement agreement (entering a negative number to reduce the interest balance).

- Escrow – add an Escrow adjustment to manually increase or decrease the balance of the loan’s escrow account. If you received an escrow deposit at the beginning of a loan, don’t use an adjustment. Instead record that deposit as a payment with the payment type set to Escrow. Escrow adjustments only affect the Escrow balance on a loan.

- You might adjust the escrow balance if you are moving an existing loan into Moneylender and you want to set up the opening balance of the account at the time that Moneylender is taking over the calculations.

- Fees – adjustments to the fees account are fairly common. Adjustments to fees will apply to the Fees balance, the Ledger balance, and (if compounding interest) the Interest Bearing balance.

- You might record a negative fee adjustment to waive one or more late fees that were incurred.

- Double-clicking a late fee from the Fees account on the Ledgers tab will allow you to automatically add an adjustment to reverse a late fee that was assessed to a loan.

- AmountDue – adjust this amount to change the amount that Moneylender expects the borrower to pay for the loan to be considered current. Adjustments to the AmountDue ony affect the AmountDue balance.

- You might record a negative adjustment to bring the AmountDue balance to zero as part of a reinstatement to catch up the loan while capitalizing any unpaid interest.

- Double-clicking a regular payment entry from the AmountDue account on the Ledgers tab will add a negative adjustment on the amount due account to defer a payment on a loan. Deferring a payment doesn’t waive interest, it just says that you don’t consider the loan to be behind and you don’t expect the borrower to submit the deferred payment.

- InterestBearing – avoid adjusting this account directly in most cases. Adjustments to principal and (if compounding interest) interest and fees are automatically copied to this account.

- Ledger – avoid adjusting this directly. All transactions that affect the balance of a loan in any way are automatically copied to this account. Adjust the specific account with the balance that needs to be modified instead of changing the ledger balance.

- EscrowDue – This account tells Moneylender how much of a payment should be taken deposited into the escrow account prior to applying the remaining funds to the loan’s other balances.

- You might increase the EscrowDue so Moneylender will take more out of a payment that the escrow amount set using the Escrow Charges as part of a one-time agreement to pay for an unexpected escrow expense on a loan.

- You might decrease the EscrowDue balance so Moneylender will take less than the accumulated escrow due from the next payment to be added to a loan.

Amount – enter a positive number to increase the balance of the account you’re adjusting. Enter a negative number to decrease it’s balance.

Date – enter the date when the adjustment should be performed on the loan.

Description – (optional) enter the reason for the adjustment, such as “Waived Late Fee”, or “Loan Reinstatement”.