Filing Electronically with the IRS through the FIRE System

1098 Walkthrough Video

1098 Walkthrough Video

You can get here by clicking Regional > United States > Form 1098 – Mortgage Interest Statement from the main menu.

Electronic filing is done through the IRS FIRE website (https://fire.irs.gov). FIRE is a system that lets you upload a specially formatted file containing the details of your 1098 returns to the IRS. To submit tax data, you must register with the IRS and receive a transmitter code in the mail (Form 4419). Registration is free, and a transmitter code is usually issued within six weeks.

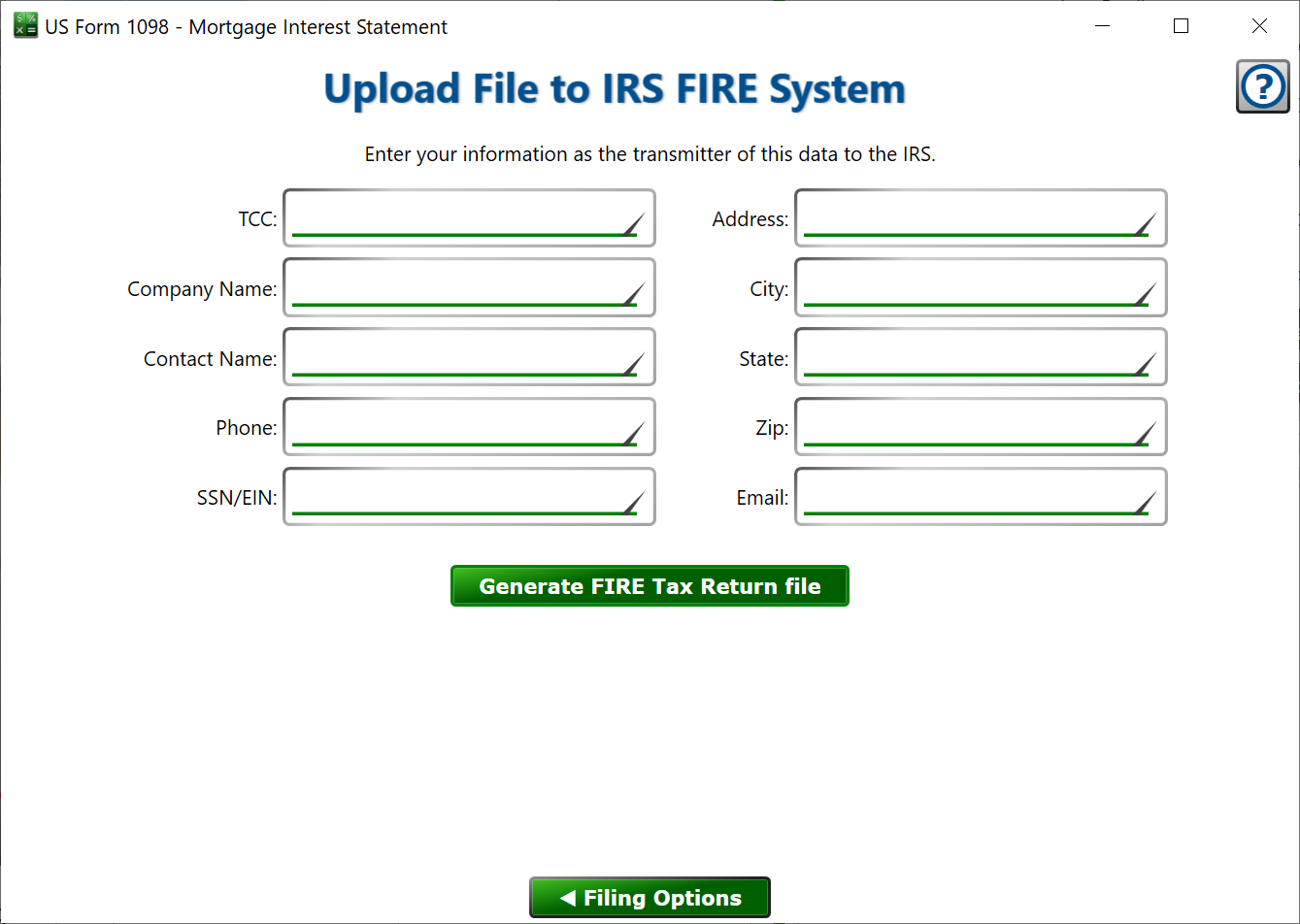

The FIRE file that you’ll upload to the IRS has a required section for the Transmitter information. Fill in the boxes with the information about the organization and contact person that is actually filing the information. This is for the IRS’s records. The transmitter is not necessarily the taxpayer or a lender.

TCC – The Transmitter Control Code issued to you by the IRS when you applied to file electronically. It’s a five-digit alphanumeric code.

Company Name – The organization that’s filing the returns. If an individual, put your name in the box.

Contact Name – The person to talk to if the IRS has questions.

Phone – The phone number where the contract person can be reached. May include an extension number.

SSN/EIN – The nine-digit tax ID of the person or business submitting the returns. This is not necessarily a lender.

Address, City, State, Zip – Mailing address of the person of business submitting the returns. Not necessarily the taxpayer’s or lender’s address.

Email – A contact email if the IRS needs to ask questions about this return.

– Moneylender will verify that the above boxes are filled out properly (some of the fields have specific requirements to be considered valid by the IRS FIRE system) and inform you if something is missing or invalid. If all is ok, you’ll be prompted to enter a file name and location where the FIRE file should be saved.

You can upload this file directly to the IRS, or you can Zip the file first and then upload the Zip to save bandwidth. Only Zip compression is allowed by the IRS.

Once you upload to the IRS, you can log back into the FIRE site to check back if the file was accepted.

– Return to the pervious page in case you want to change your filing choice.

See also:

Preparation

Borrower Selection

Correction

Printing for Borrowers

IRS Filing Options

We eFile Your Returns

You eFile Your Returns

You Print Your Returns