Portfolio Numbers Settings

These settings are critical to setting up Moneylender the way you need it to work.

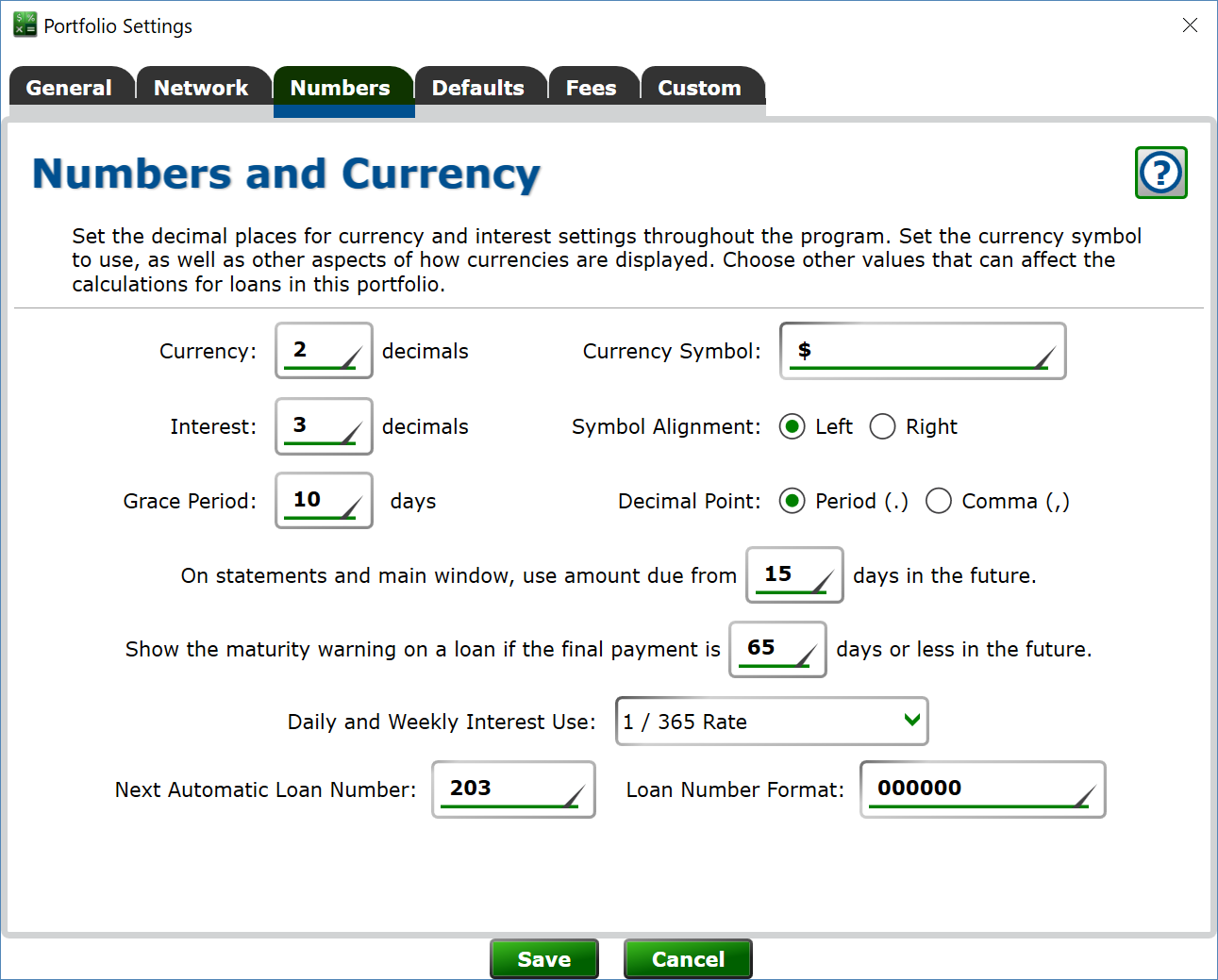

Currency precision - how many decimal places to round all currency values and currency transactions in the portfolio.

Interest precision - How many decimals you want to enter when entering the interest rates on loans. This precision is also used when setting up late fees as a percentage of regular payment, and the percentage ownership for lenders.

Grace Period - how many days before a payment is considered late, by default. Each loan can use this grace period, or specify its own.

Currency Symbol - The label to put before or after numbers that represent money. It can have multiple letters. If you want to use the program without any currency symbol, leave it blank.

Symbol Alignment - Use this to position the currency symbol to the left or right of currency numbers. Throughout the program.

Decimal Point - non-functional. Should allow changing the decimal point between a period and comma, but the system settings don't want to be overridden. Would be useful if lending to countries that use a different standard than the country where the user's computer is.

On statements and main window, use amounts due from X days in the future. - This determines when Moneylender will start expecting the upcoming payment. You can adjust this setting based on your own business process. If you print statements roughly 10 days before the upcoming due dates, using 11 or 12 will cause Moneylender to push forward just before you run your statements. If your loans are weekly loans, you might use a two day period so you can send out statements via email a day before payments are due. If you like to send statements out well ahead of time, you can set this to 20 days or even longer. You may wish to set it to zero if you don't send statements at all.

Show the maturity warning on a loan if the final payment... - When a loan's last payment is approaching, Moneylender will add a warning to the loan so you can send a payoff quote or otherwise make arrangements with the borrower to settle or extend the loan. This setting lets you decide how much advance warning you want to prepare for loans that are reaching maturity.

Daily and Weekly Interest Use - this is a global interest modifier. Daily interest is calculated using a variety of rules, and you can choose the rule you are using for your loans. Each loan can be set to use this global value, or to override it with another value.

Next Automatic Loan Number - Set this to the next number to use when automatically generating a new loan number. You can change this at any time, even to a number that has already been used. Be careful not to create undesired duplicate loan numbers. An example of resetting the number might be if you use 'YY' in the number format and you like each year to start over a 001.

Loan Number Format - This field defines how the automatic number is formatted when creating a new account. It has these rules:

Enter 0s to define the part that will hold the number. The account number will be padded with zeros if you specify more zeros than there are digits in the next loan account number. For example, '0000' would create account numbers '0001', '0101', '18095' etc. If more digits are needed than there are zeros in the format string, the extra digits are added.

'YYYY' will be replaced by the four digit year.

'YY' will be replaced by the two digit year.

'MM' will be replaced by the two digit month.

'DD' will be replaced by the two digit day.

Any '#' symbols will be replaced with a random digit from 0 to 9.

If the format string contains any # symbols, Moneylender will attempt to avoid creating duplicate account numbers. If, for example, you set the format string as "LOAN#", you could only have ten possible account numbers. Moneylender will try to avoid using the same number twice, but there are only ten unique loan numbers possible with this format. If it can't, after a reasonable number of tries, randomly generate a unique loan number, it will allow duplicates. To prevent this, ensure there are enough #s in the format string to accommodate the number of loans in your portfolio. We recommend six or more – like "LOAN######". # can be used in conjunction with 0s and date formatting.

Any other text will remain intact.

With next number 203 and format 'WTCYY0000', the resulting auto-number would be 'WTC180203' (it's 2018 at the time of this writing).