How to Set up a Loan with a Balloon Payment

If your loan uses an interest-only payment prior to the balloon, when you create the loan, you can just enter the term and then choose the interest only payment amount from the suggestions.

If your loan will be amortized over X years with a balloon in Y, it’s easy to set up in Moneylender by following these steps. If you already created the loan, look a little further down the page for how to adjust the payment settings to amortize and then balloon.

New Loans

Create your loan using the Amortized Loan Wizard. Clicking the New Loan button on the main window will start the Amortized Loan Wizard by default, or click Loan > New Loan > Loan.

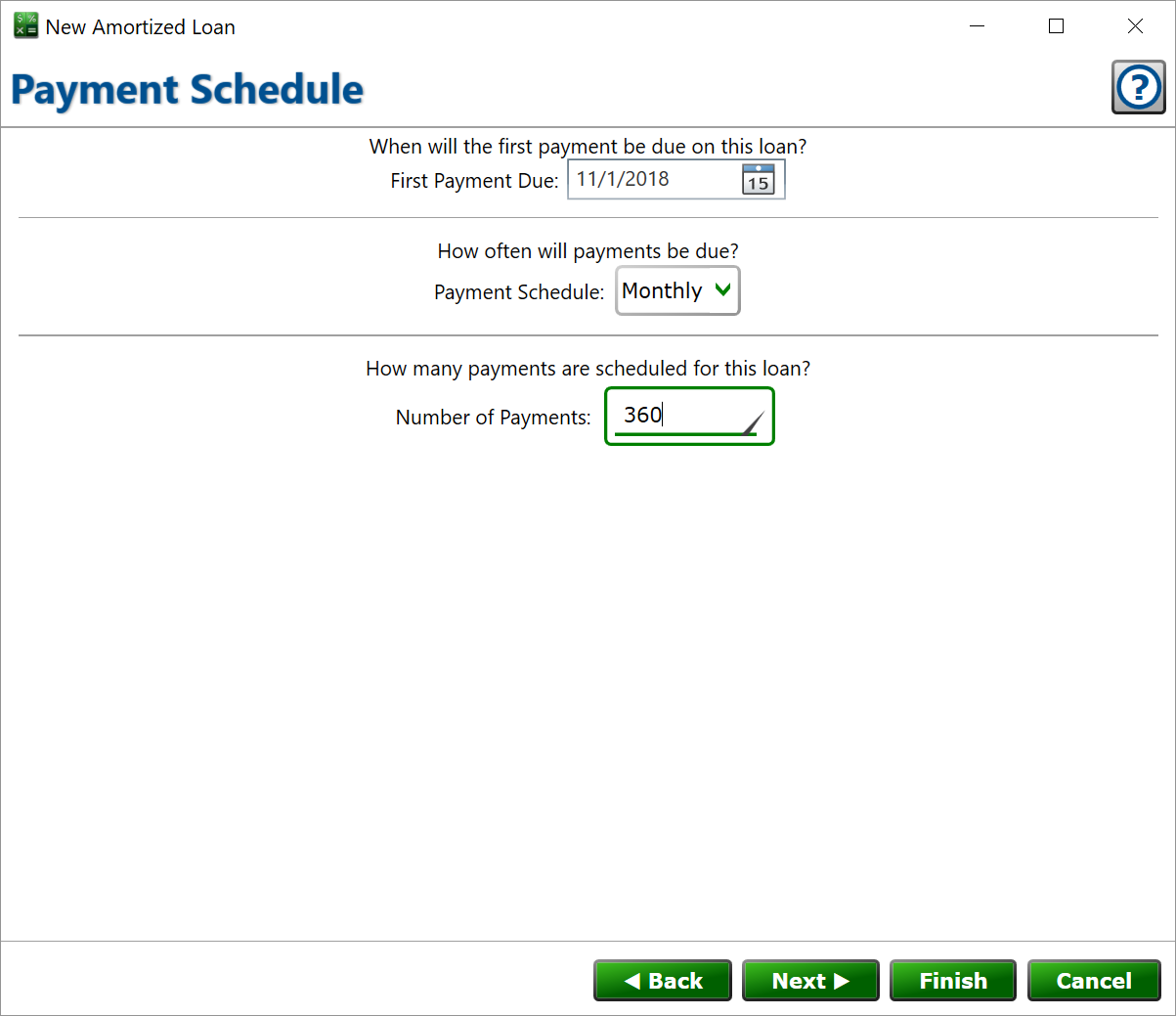

On the Payment Schedule page, enter the schedule as it would be for the amortized payment. For example, 360 monthly payments for a 30-year amortization. Click .

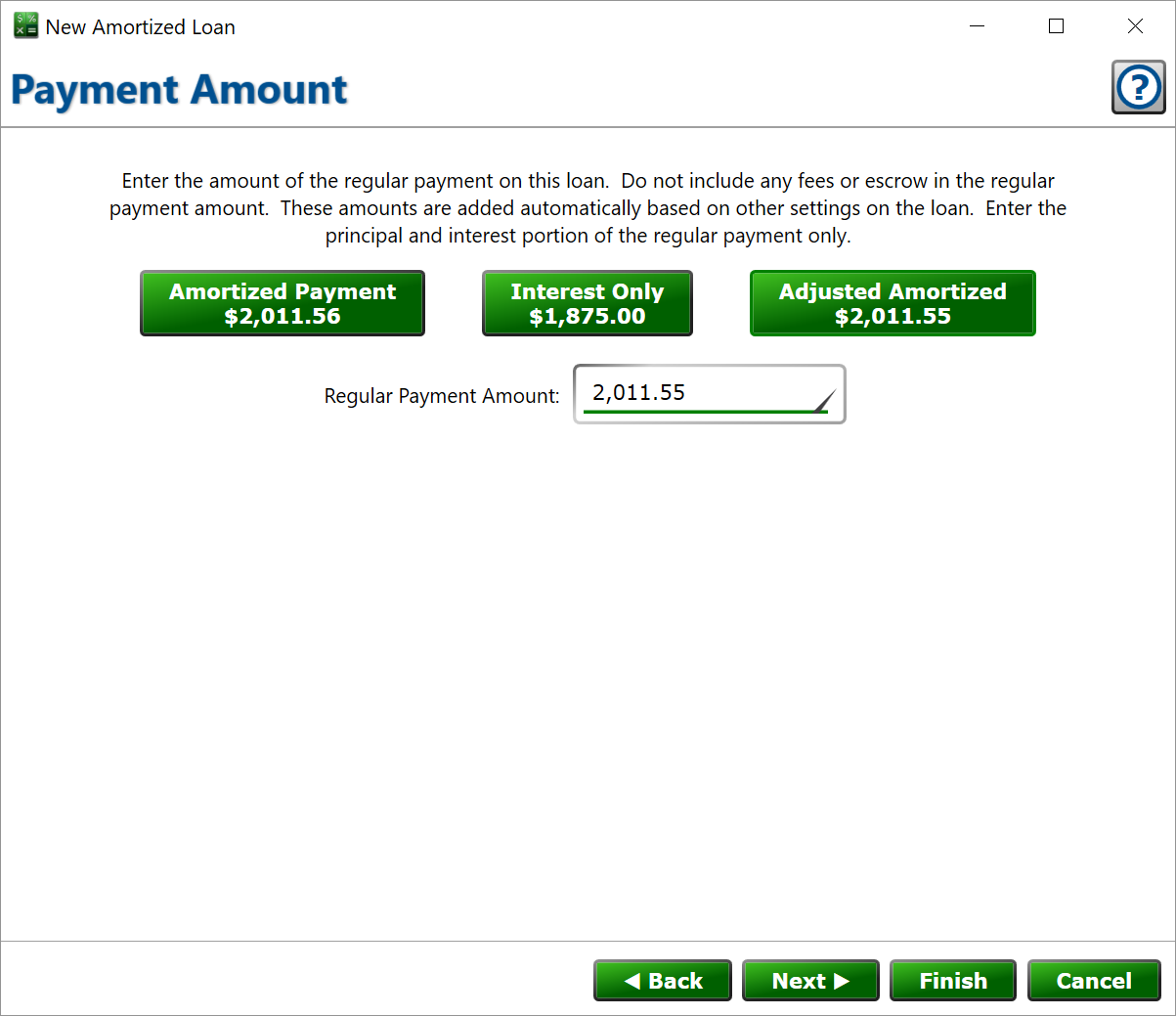

Choose the payment option that fits your loan – either or to set the regular payment amount on the loan.

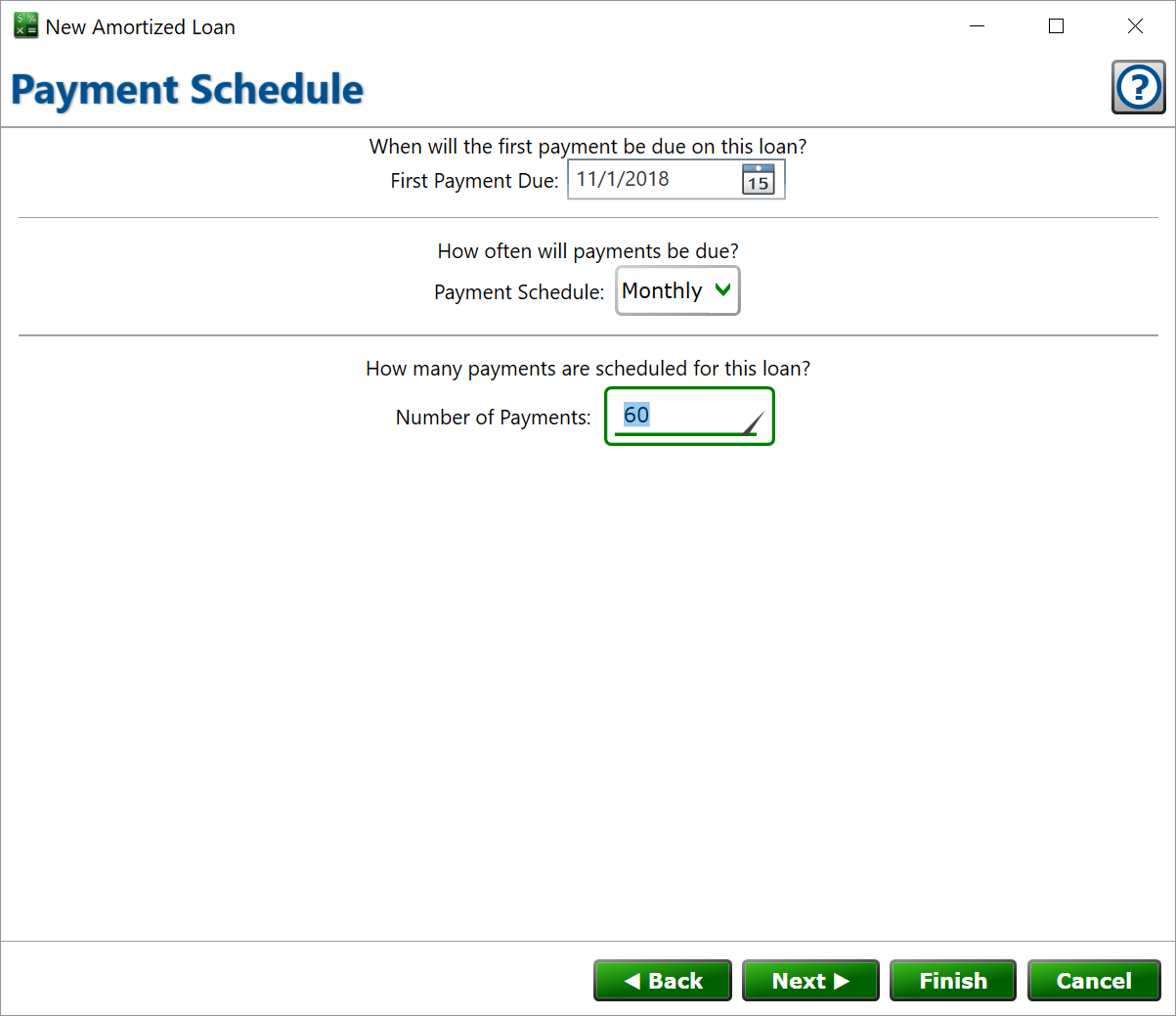

Click and change the number of payments to the balloon term. This will have the loan end in the shorter period. Click a couple times to review the late fee and other settings before clicking .

Existing Loans

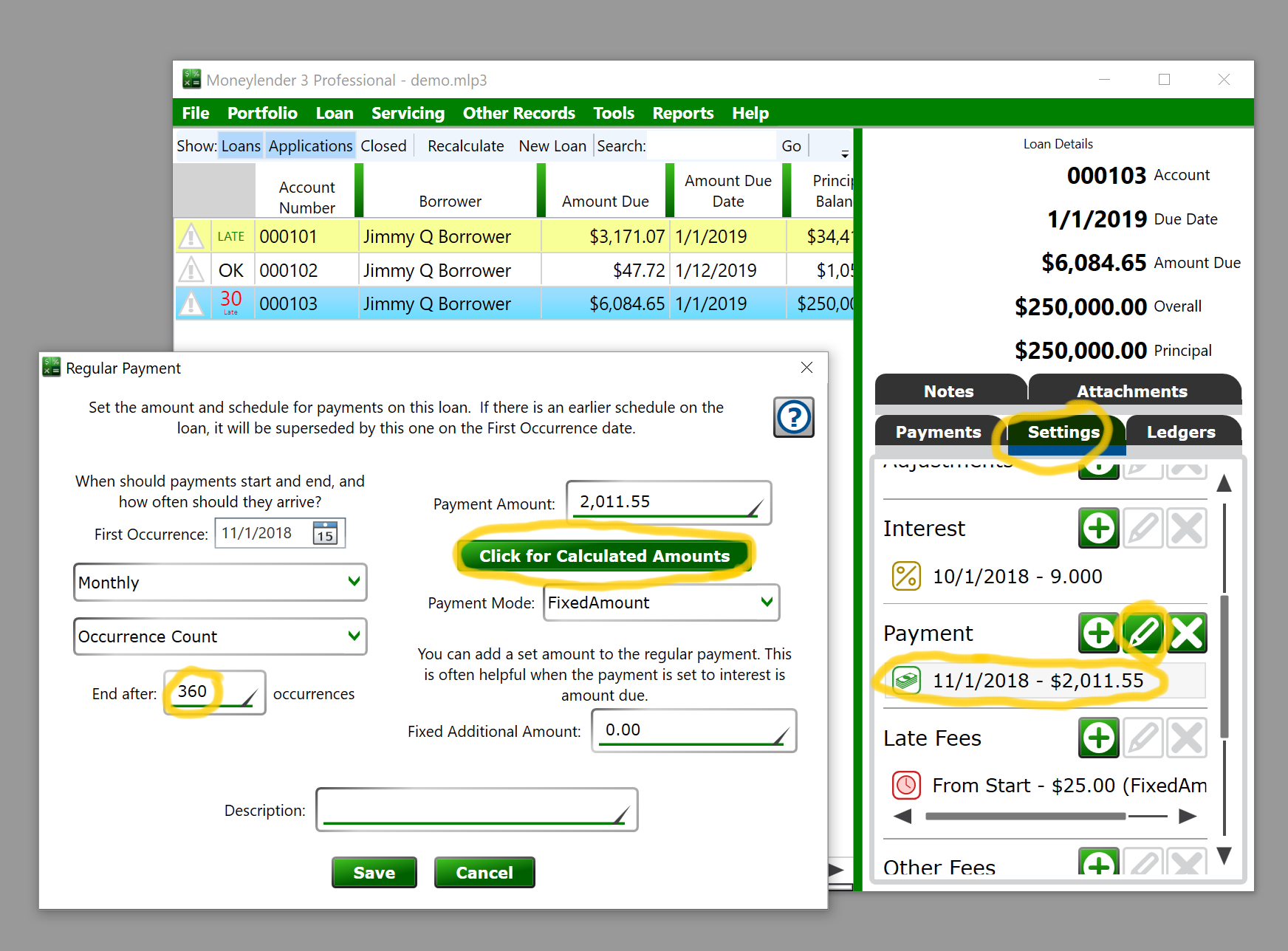

If you already created the loan, but the settings didn’t come out the way you wanted, you can still adjust the payment amount and timeline. Select the loan, go to the Settings tab’s Payment section. Select the payment setting and click Edit

![]() .

.

Set the occurrence count to the “amortized over” period, like 360 payments. Click the button. Choose the payment amount you want. Change the occurrences to the balloon term, like 60, and click .

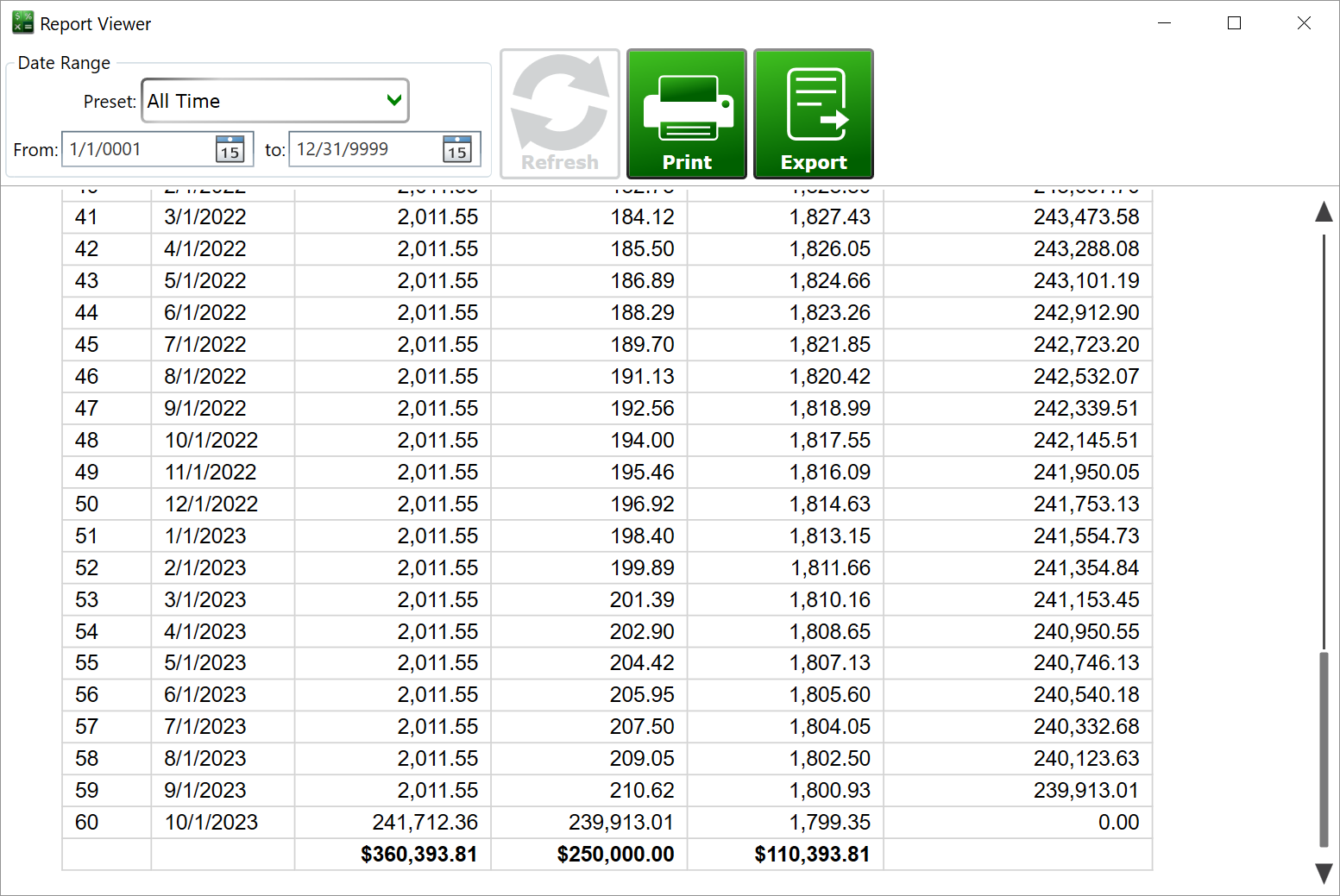

Confirm the Amortization Matches Your Expectations

Once your balloon loan is set up, you can run an amortization report to confirm that the payments and balloon match your expectations.