Do you need powerful loan software for business? Moneylender has a calculation engine that can manage the balances on loans regardless of what happens in the real world. Once you set the rules Moneylender will use to calculate the loan, whatever happens with the borrower and their payments, Moneylender will apply the payments according to the rules properly. The calculation engine is fully auditable and defensible. All calculations are engineered to calculate the reality of repayment and the resulting balance in a way that is always fair to the borrower and reflects the spirit of the contract properly.

You can modify every notice, statement, quotation that comes with Moneylender. You can even create your own communications from scratch using the powerful template editor. From generating your custom loan contracts to your paid-in-full letters, Moneylender can produce any kind of document you might need for your loans. Once you create the template, Moneylender can create the document for any of your loans whenever you want.

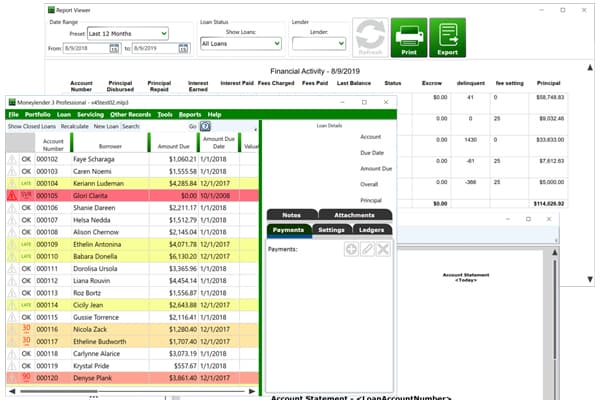

Incredible UI/UX

The main window of this loan software is your main dashboard view. See all of your data that matters to you most for every loan you carry.

Simple & Easy

It is so simple and easy to create and make modifications to all of your loans. You can record payments, send notices, create documents, get reports with all types of data, and much more.

20+ Years Strong

Moneylender has been running and being continually updated for over two decades! Businesses love our loan software to do what you need to do fast and easy.

All of the reports that Moneylender loan servicing software comes with can be customized. Add and remove columns. Virtually all amounts (earned and paid) for any date range can be added as columns on a report. Different report engines let you see different kinds of information – from the interest calculations to the payment history on a single loan, all the way through to portfolio-wide profit and balance analysis and payment reconciliation.

All reports can be exported to CSV, and you can even copy/paste report data from the report viewer into a spreadsheet.

If you compare the other systems and solutions of loan software for businesses, Moneylender is extremely affordable. It runs on your computer, which means there’s no subscription to pay, no recurring fees. Buy a license and you own the license. Upgrade access can be purchased at any time to upgrade your license to the latest version of Moneylender if there are new features and enhancements that you want to use.