Attention car dealerships generating their own auto loans! Many dealerships that do their own financing use Moneylender Professional to track their loans. Moneylender is powerful software for car loans. Our easy-to-use system gives you everything you need to manage the debts. Easily tell when a borrower is current, due, and delinquent. Give payoff quotes. Track loans you sell to investors – partial shares or entire loans.

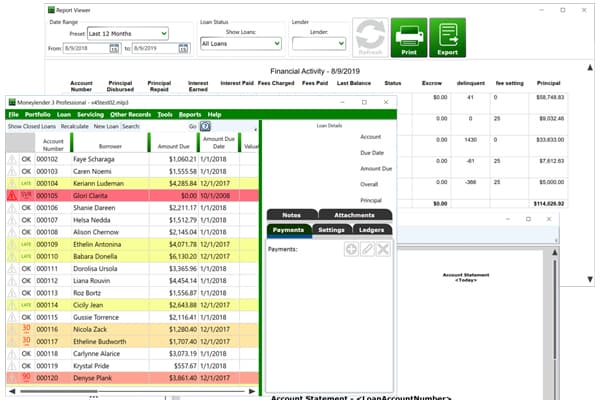

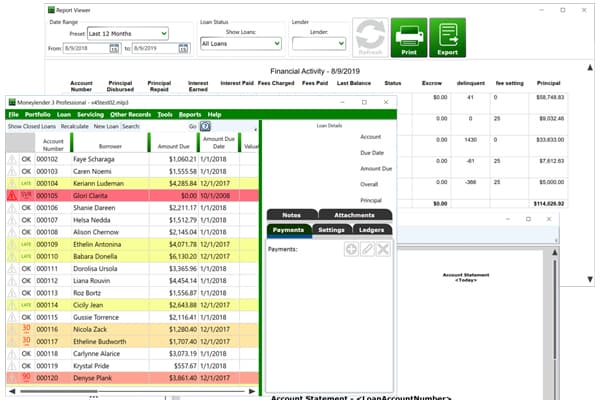

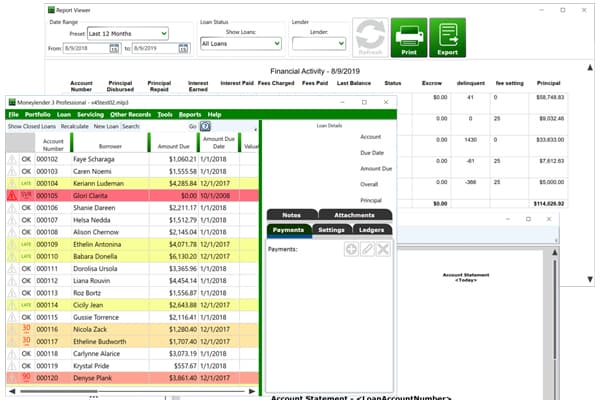

Moneylender automates all the calculations on your loans for you, including effortlessly handling extra payments and providing payoff quotes. If a borrower gets behind, their loan is highlighted in the main window with different colors depending on how far behind they are. Record their payments, whatever the amount is, and Moneylender knows how to apply the payment and how current the loan is as a result. It is a truly automatic calculation system. If you want to override the rules for any reason, like waiving some interest or fees to help a borrower out, for example, you can adjust any balance on the loan at any point in time.

Export loans to give to your investors, but keep them all in one file for yourself. If you sell the paper to investors, but continue to service the loans yourself, you can export batches of loans to separate portfolios to send to your investors while maintaining the convenience of managing all the loans together. Moneylender supports having the borrower interact with one lender (you) while the funds are attributed, in whole or in part, to one or more other lenders. You can run reports that show the independent totals for each investor that owns some of the debt in your portfolio.

Amazing UI/UX

The main window of this automobile loan software is your main dashboard view. See all of the data that matters most to you for every loan.

Easy To Use

It is so easy to create and make modifications to your loans. You can record payments, send notices, draft letters, and get reports with all types of data from your loans.

Used For Over 20 Years

Thats right! Moneylender has been used by many for more than 20+ years! Its a favorite for servicing car loans to do what you need to easily and quickly.

Moneylender loan servicing software supports fields like collateral for a description of the asset that’s securing the loan. It also supports adding custom fields like VIN and insurance carrier/policy number. You can even put these custom fields on the main window, onto statements, or onto reports if you want.

Moneylender car loan software also has all the tools you need to collect on your loans: