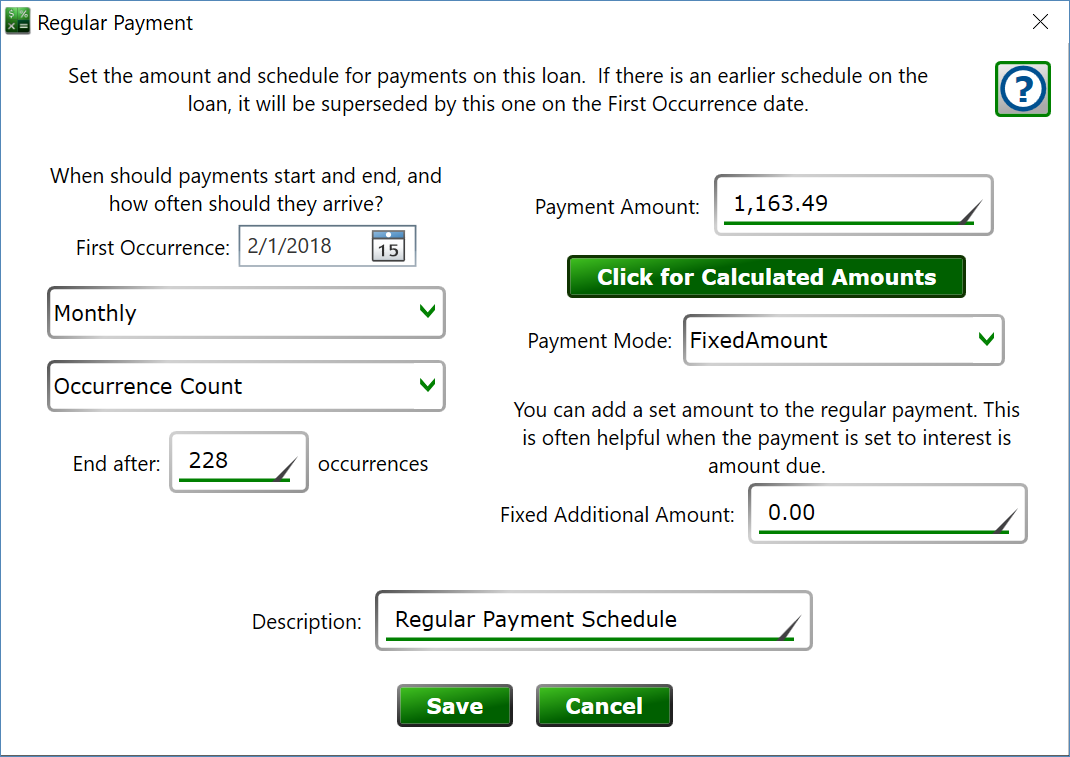

Regular Payment Window

You can get to this window from the Settings tab of the Loan Details panel on the right side of the main window by clicking the New (plus) button in the Payment section, or selecting an existing payment setting and clicking the Edit (pencil) button.

The Regular Payment record determines when and how much money is due on a loan. Regular payments can overlap each other, allowing two or more ongoing schedules. For example, you might have an interest-only payment that is due quarterly, and one per year there might be a payment of curren 2000 due to pay down the principal.

First Occurrence - Enter the date when the first payment under this schedule is due.

Schedule Frequency drop-down – choose the frequency that these payments will be expected from the borrower.

Ending drop-down – when should Moneylender stop expecting these payments from the borrower?

No End – the payments will be due indefinitely.

Occurrence Count – a set number of payments are due, for example 60 monthly payments on a five year loan.

Ending Date – choose a date, and the recurrence will stop on or before this date.

Payment Amount – enter the amount that is due on each occurrence of this scheduled regular payment. You can enter any amount here.

Click for Calculated Amounts – this will open the Payment Calculator window which will do a little math to suggest a regular amortized payment amount and an interest-only payment amount you can use. Click a button on this window to set the chosen number in the Payment Amount box.

Payment Mode – Use FixedAmount to have the amount entered above as the amount that will be due on each time. Use InterestIsAmountDue to ignore the Payment Amount above and to set the amount due based on the accumulated interest on the loan. InterestIsAmountDue is quite common for construction loans and lines of credit, where the payment is often just the outstanding interest and there are frequent principal draws that cause the interest amount to fluctuate from due date to due date on the loan. If there will not be frequent draws on the loan, it may be better to use the calculator to set the fixed amount of the payment to the normal interest-only payment amount.

Fixed Additional Amount – an amount to add to the normal payment amount – particularly if the interest is amount due. For example, a revolving line of credit might have a regular payment of the interest due plus 20 of principal.

Description – (optional) a note about the payment amount.