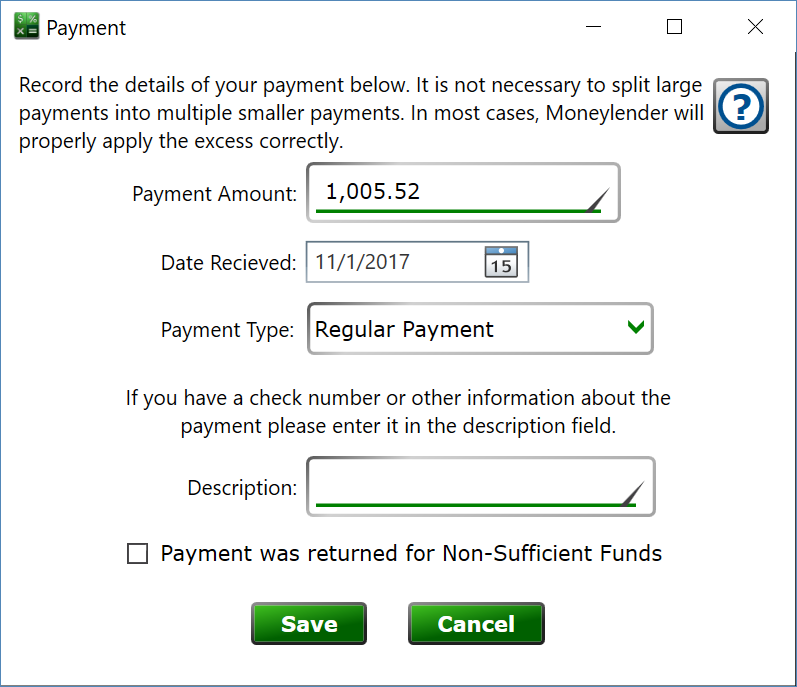

Payment Dialog

The Payment Dialog allows you to enter or edit the details of a payment on the loan.

Payment Amount - Enter the amount of the payment, whatever it happens to be. Moneylender 3 has a sophisticated calculation engine that can properly apply under- and over-payments in most situations. If only a partial payment is made, Moneylender will credit the loan, but will not advance the due date until the full amount due is received. If an overpayment is made, Moneylender will detect if the payment should be treated as payment for multiple due dates, extra payment toward the principal balance, or payment towards amounts in arrears.

Date Received - Enter the date you consider the payment received from the borrower. If a borrower direct deposited, it might be the date the deposit arrived in your acocunt. If received by check, it'll be the date it arrived or possibly the postmark date.

In nearly all cases, use the Regular Payment setting, with a few exceptions...

Interest Only - when selected, these funds will not affect the principal on a loan. It will be treated as a regular payment but any extra funds will be prevented from paying principal. If the payment greater than the interest currently earned on the loan, the extra funds will be applied to future interest when it is added to the account. This payment will affect the amount due on the loan in the same way a regular payment does.

Final Payment - The final payment on a loan should be marked as a payoff payment. A final payment will have exactly the same effect as a Regular Payment except an early payment will never be held until an upcoming due date. Especially important at the end of the loan when the loan will close before the next due date, it can also be useful if you have partial or special payments that should be applied as soon as they're received instead of waiting to the next due date. If a Regular Payment isn't doing what you need, switching it to a Final Payment may give you the desired result.

Principal Only - This payment will be applied exclusively to the principal balance on the loan. It will not affect the amount due on the loan.

Escrow Only - This payment will be deposited into the escrow account on the loan. It does not affect any other calculations on the loan, nor will it affect the amount due, including the escrow amount due. Use this setting when an escrow deposit is paid by the borrower to initially fund the escrow account, or when an escrow shortfall is addressed with a deposit payment.

Prepaid Interest and Fees - Use this option to enter the amount paid by the borrower when the loan was originated to cover the initial per-diem interest and/or any closing fees on the loan.

Description - Enter a check number, transaction number, or other description in the description box to help reconcile the payment history if the borrower has questions about their account.

Payment was returned / unsuccessful. - If a borrower's payment bounces, check this box. Moneylender will ask if you wish to add a fee to the loan as well. This will retain the historical record of the payment, but the payment will be omitted from balance calculations and some reports.

Show payment overrides. - Available for Regular, Interest Only, and Final Payment types. This will display the override boxes on the right side of the window.

Override Amount Boxes - When all these boxes are set to zero, Moneylender's calculator will determine the allocation of all the funds from the payment. If you enter numbers into these boxes, it will take those funds away from the calculator's logic and then re-add them after the distribution of the payment has been determined. For example, if a borrower sends you a payment with an extra ¤200 intended for their escrow account, entering 200 in the Escrow box will force those funds to go toward escrow and the remaining funds will be applied by the calculator normally. DO NOT USE THESE BOXES TO MANUALLY CONTROL THE NORMAL SPLIT OF INTEREST AND PRINCIPAL FROM ALL YOUR PAYMENTS! If the terms of your loan contract are set up properly on the Settings tab, you do not need to override payments under nearly all circumstances. Use these overrides sparingly, and only indicate the amounts that you want to deviate from the normal calculations. If a payment is applying entirely to interest because the borrower is very late, you can set a principal amount in the override box and it will force Moneylender to put some of their funds towards their principal balance even though they have unpaid interest outstanding on their loan. Do not use these boxes to manually dictate all the funds from normal payments - that's a sure sign you didn't set up your loan properly on the Settings tab.

Custom Fields - If you have specified any custom fields for the payment record, they'll appear on this form and you can set their values accordingly. Shown above is a custom field called "Method".