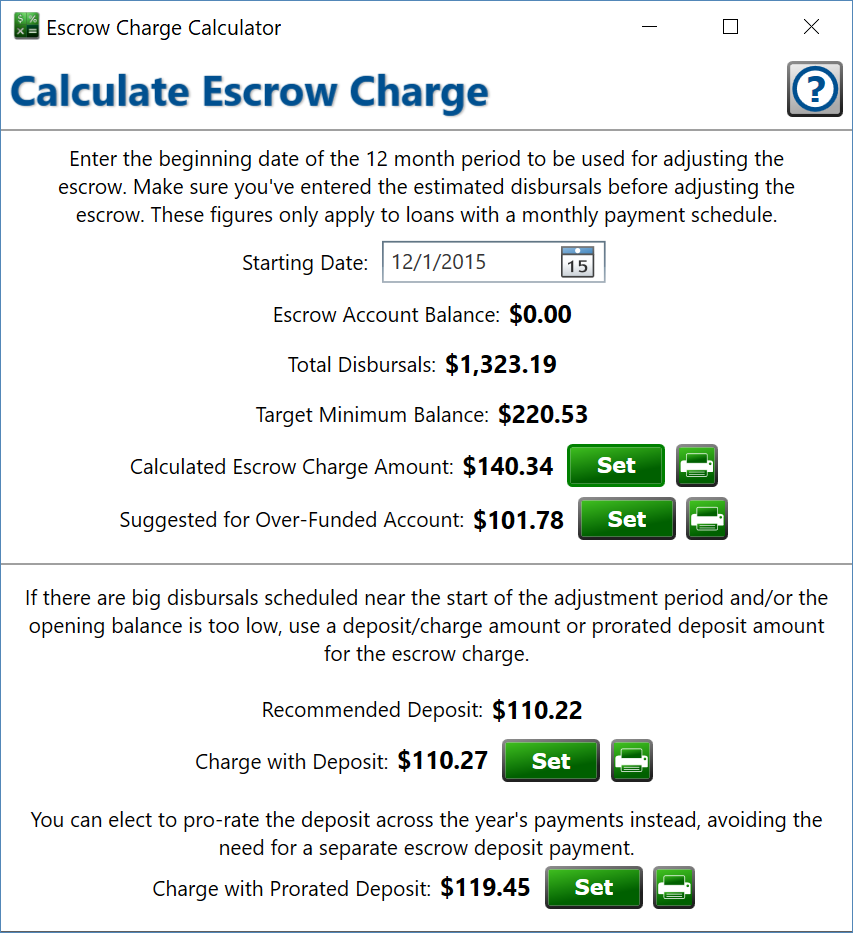

Escrow Charge Calculator

Get here by clicking the Escrow Account button on the Settings tab of the main window and clicking the Adjustment Calculator button.

The adjustment calculator uses the scheduled and paid disbursements on the escrow account to determine the amount of money to add to the regular payments to properly fund and maintain an escrow account. You can choose from several options.

Starting Date - enter the starting date for the escrow analysis period. Most often this is January 1st of the current or upcoming year, but it can be any date that makes sense on your loan. You can run the analysis whenever you want to refresh the escrow charge amount; if you do the analysis starting in July this year, you can do another one for January the following year.

The twelve months following the Starting Date is called the analysis period.

Escrow Account Balance - this shows the actual balance of the escrow account on the selected date.

Total Disbursals - this shows the sum of all the disbursals (paid and estimated) for the 12 months beginning on the selected date.

Target Minimum Balance - this is one sixth of the total disbursals, it is a two month reserve amount.

Below this are four suggestions for the escrow charge.

Calculated Escrow Charge - based on the timing of the disbursements and payments on the loan, this is the amount that must be collected with each payment so the lowest balance in the escrow account at the end of any month is the target minimum balance. This may be very high if escrow disbursements happen earlier in the analysis period. In such cases, you will have options below the horizontal line for assessing or prorating a deposit to the escrow account.

Suggested for Over-Funded Account - this amount will allow you to gradually lower the escrow balance on the account. The amount will collect 11/12ths of the total disbursals, lowering the escrow balance by approximately one month's worth of deposits. Slightly less funds will be added over the analysis period than will be paid out, and the balance at the end of the analysis period will be a little lower than it was at the beginning. If the Calculated Escrow Charge is much less than this amount, it may be preferable to use this number to avoid a calculated escrow charge next year that is substantially higher.

Recommended Deposit - if there are big disbursements from the escrow account early in the analysis period, collecting a deposit will allow you to have a much more reasonable monthly charge. The suggested deposit starts by splitting the total disbursements evenly across the payments in the analysis period. The deposit shown is the amount needed to raise the minimum balance during the analysis period to the target minimum shown above. If a deposit is collected this time, the starting balance a year later will likely be sufficient to avoid the need for another deposit.

Be sure to record the deposit payment as an Escrow payment when entering it on the loan so the funds are properly directed to the escrow account.

Charge with Deposit - this amount will be simply the total disbursements for the year divided by the number of payments.

Charge with Prorated Deposit - instead of assessing and collecting a deposit from the borrower, you can choose to prorate the deposit across the regular payments instead. This will result in the same Escrow balance at the end of the analysis period, but at times during the year the Escrow balance will fall below the target minimum or even become negative. If you are confident in your borrower, this is often the best choice when an escrow account is getting started or there were significant increases in disbursements.

buttons - Once you have decided which option best suits your situation, click the Set button next to that option to create a new Escrow charge setting for the selected amount.

![]() Print buttons - click this button to print an Escrow adjustment letter for the amount and deposit details you have chosen.

Print buttons - click this button to print an Escrow adjustment letter for the amount and deposit details you have chosen.

See also: Printing the Escrow Analysis Letter