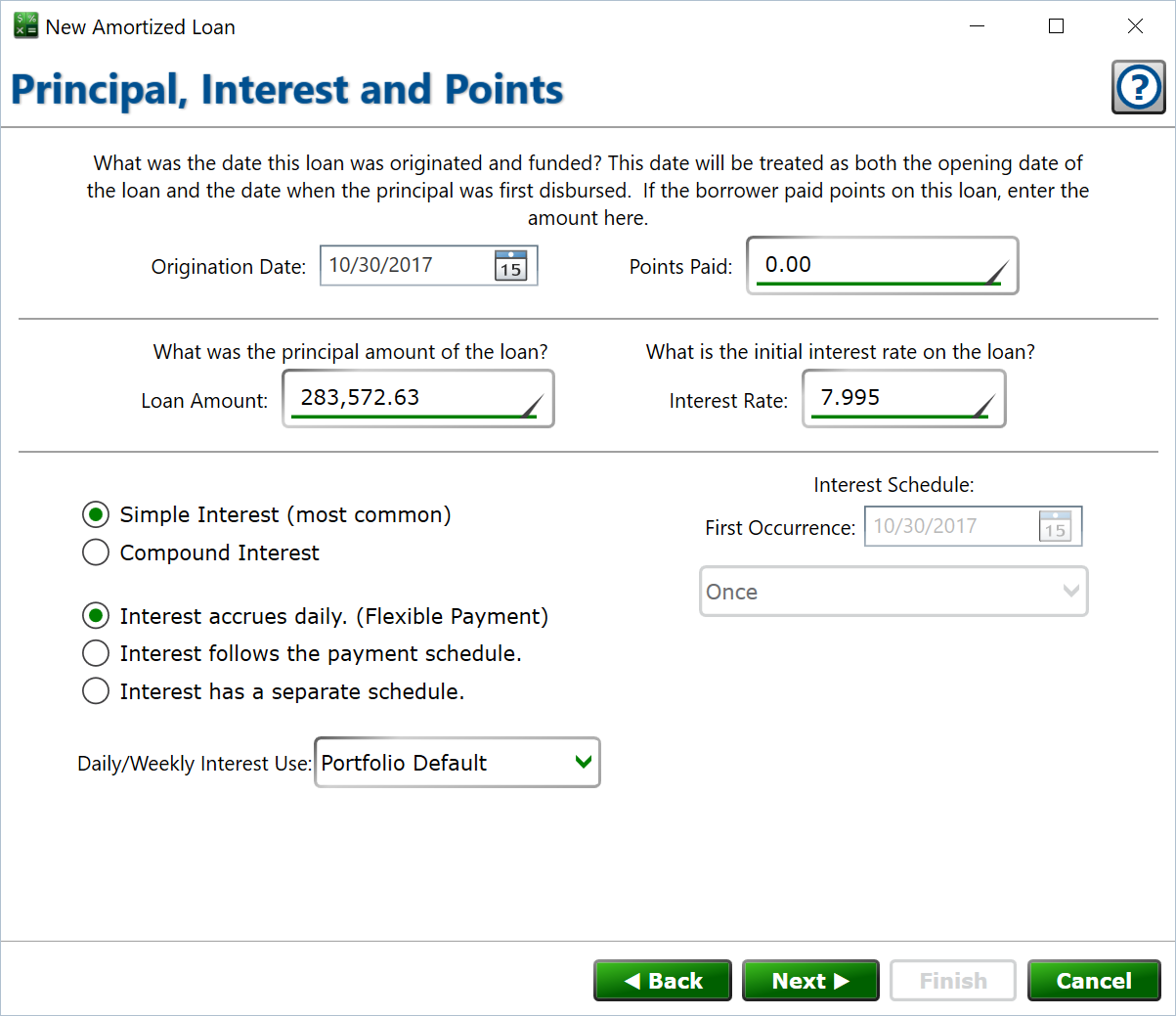

Principal, Interest and Points

Previous Step: Account Number, Borrower, Lender

Next Step: Payment Schedule

On this dialog, we'll set up most of the basics on the loan.

Origination Date and Points

Enter the date when the loan was initially funded for the Origination Date.

If the borrower paid points, enter them here.

Loan Amount and Interest Rate

Enter the principal disbursed at the time the loan was opened for the Loan Amount.

The interest can be fixed, or change over time, but to get started, we'll set the opening interest rate on the loan.

Simple vs. Compound Interest

When choosing between simple and compound interest, there can be some confusion. Compounding interest is actually illegal in some places, so check with your local laws if you think you should use compound interest. If your loan agreement doesn't specifically permit you to charge interest on the unpaid interest balance on a loan, select Simple Interest. If you are setting up a mortgage, select Simple Interest.

Always select Simple Interest unless you're 100% certain you're legally allowed and contractually entitled to charge compound interest.

Interest Schedule Type

If the interest should be calculated based on the number of days between payments, use the "Interest accrues daily" setting. This setting is very popular across all types of amortized loans. If your loan contract doesn't specify the exact mechanism used to determine when and how interest will be added to the loan, or if it states that interest will be determined based on the number of days between payments, you can use this setting.

"Interest follows the payment schedule" the standard for amortized loans. If payments are monthly, this will cause 1/12th of the annual interest to be added each month based on the prevailing balance on the due date, regardless of the exact number of days between due dates or payments.

"Interest has a separate schedule" allows you to select a specific schedule for the interest that is not connected with the payments' due dates, and does not use Moneylender's daily interest mechanism. For example, interest may be added quarterly, but payments are made annually or monthly.

Daily Interest Modifier

Daily/Weekly Interest Use allows you to set the fractional rate to use for periods of the loan where interest will be calculated on a daily basis, regardless of the interest setting. This number is used throughout the loan if "Interest accrues daily" is selected. It can also apply at various times on other loans. For example, if interest is monthly on the payment schedule, but there's more or less than one month from the origination to the first payment, Moneylender will determine the interest due based on the number of days from the origination to the first payment. When determining a payoff quote, this setting will affect the per-diem interest calculated.

Interest Schedule

If using a separate interest schedule, you can specify when interest starts and how often it will be charged in the section titles "Interest Schedule".