Import Loans - Borrower Matching

Moneylender prefers to have one place where the information is authoritative and to have all places where the information is used point to the single source. In this case, Moneylender wants to have one record of the borrower and have all that borrower’s loans point to the single record. If you change their address, the new address automatically applies on all their loans, for example.

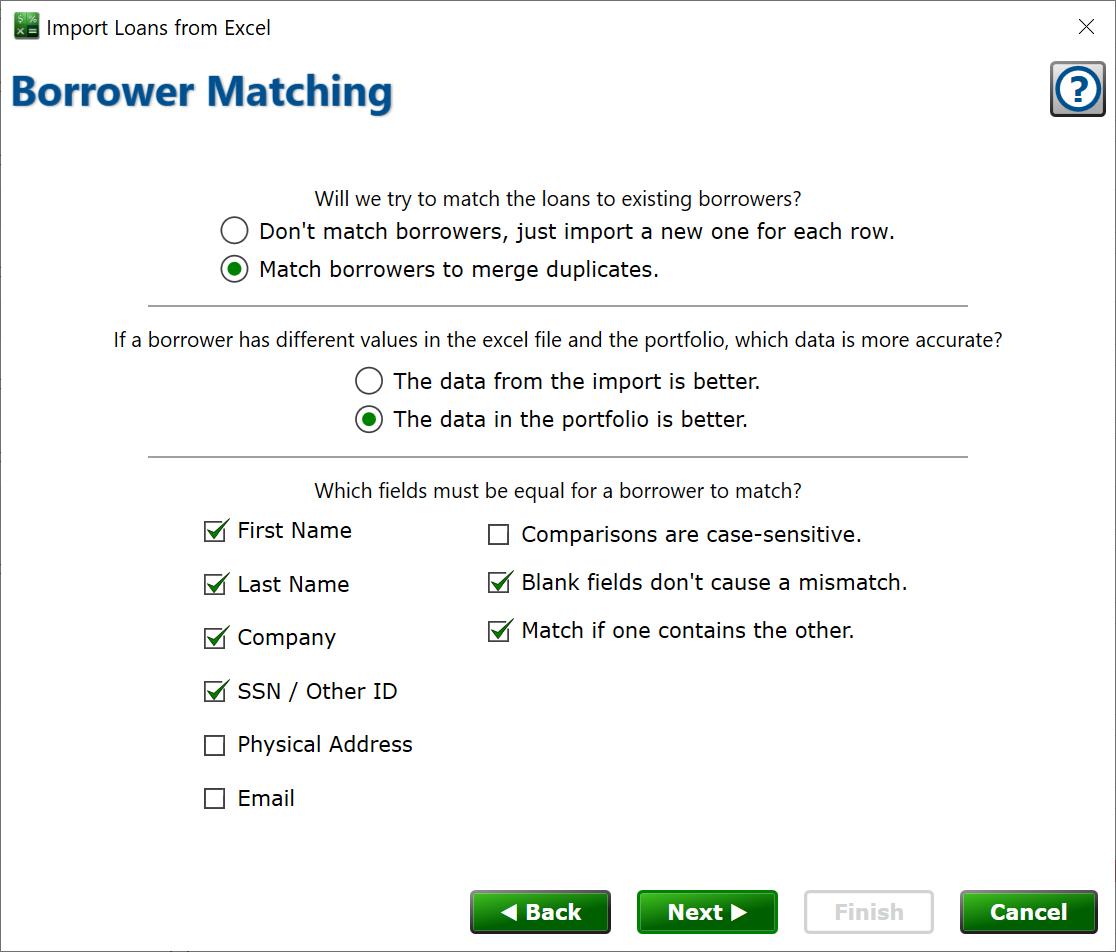

During an import, Moneylender can check to see if the borrower on a loan is already in the portfolio, and link the imported loan to the existing borrower rather than create a new borrower with the same information. To allow this, choose “Match borrowers to merge duplicates.” If you want every loan to have an independent borrower record that will be managed separately, even if the borrower is the same person, choose “Don’t match borrowers.”

If you choose to match borrowers, Moneylender will copy fields with data from one source into fields that are blank on the other source. If the import has more up-to-date information than your portfolio in Moneylender does, you can have Moneylender update the existing borrower with all the details from the import by choosing “The data from the import is better.” If the portfolio is more frequently updated than the source of your import data, you can choose “The data in the portfolio is better” and Moneylender will only add data from the import where the fields are blank in the portfolio.

When Moneylender is comparing borrowers to determine if the borrower is a match or not, you have several options to control that comparison. The left-side boxes determine which fields are compared to decide if the borrower is a match. If you only check “First Name” and nothing else. Moneylender will treat “Joe DeSouza” and “Joe Pannicki” as the same person because their first names are the same. If First and Last Name are both checked, this mismatch won’t happen.

Comparisons are case-sensitive – if checked, JOE, Joe, and joe are all treaded as different and not matching. If unchecked, these are considered a match.

Blank fields don’t cause a mismatch – if checked, Joe DeSouza with no company, will match Joe DeSouza from Landslide Excavating. Since the company was blank in the first record, Moneylender will treat it like they are the same borrower but the second record just has more information about the borrower. If this box is unchecked, Moneylender will consider Joe with a company and Joe without a company as two distinct borrowers. If both borrowers are blank, this is always considered a match since both fields are equal.

Match if one contains the other – when checked, Moneylender will perform an extra step in the comparison. “Landslide Excavating” and “Landslide” would be considered a match. Similarly, “Steve” and “Steven” would be considered a match. “123 Apple” and “123 Apple Ln” would be treated as matching addresses. “Joe” and “Joseph” would not be considered a match, however, because “Joseph” doesn’t have “Joe” in it.

All steps for Loan Import:

Getting Ready

Choose Source File

Choose Lender

Choose Loan Wizard

Wizard Mapping

Borrower Matching

Borrower Mapping

Post Process Edits

Additional Configuration Records

Additional Settings Mapping

Backup Portfolio

Progress

Results