|

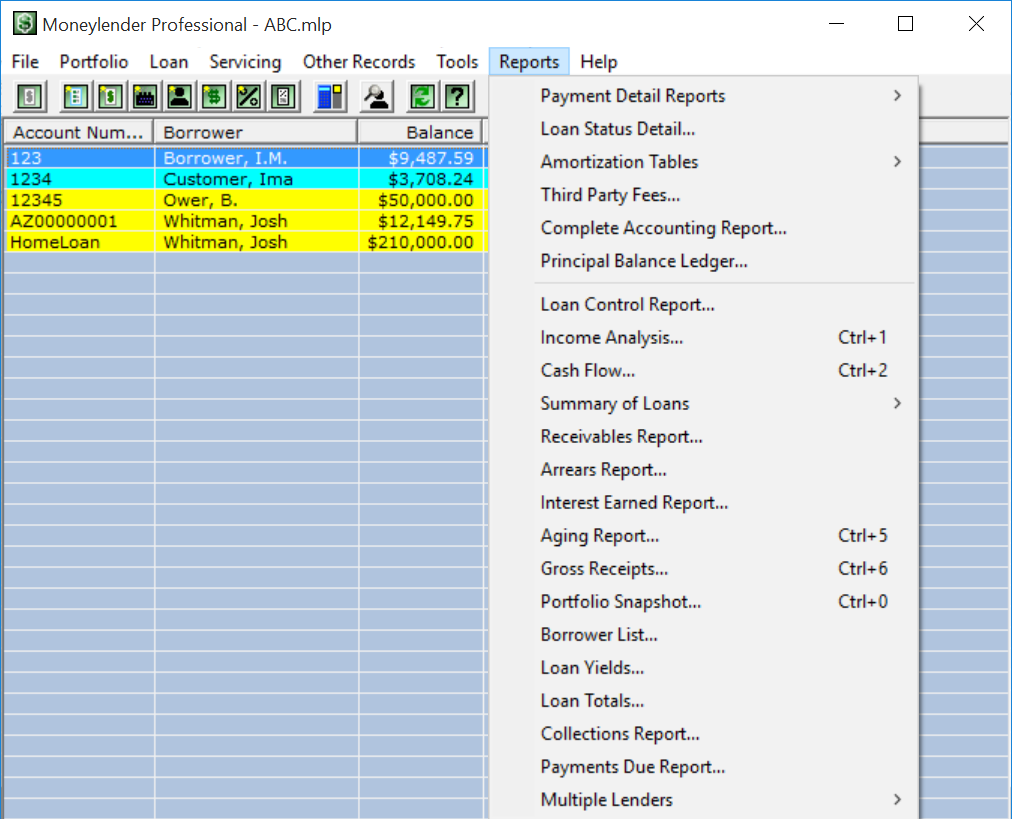

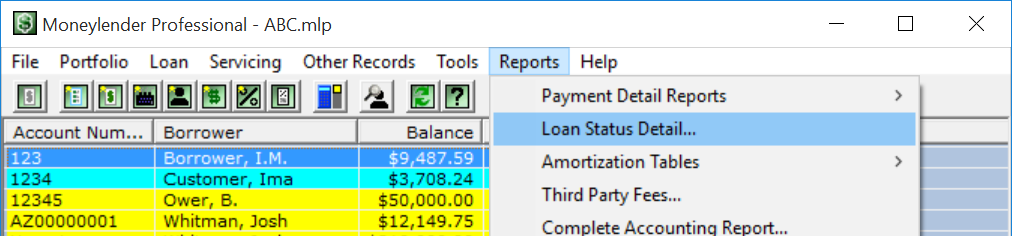

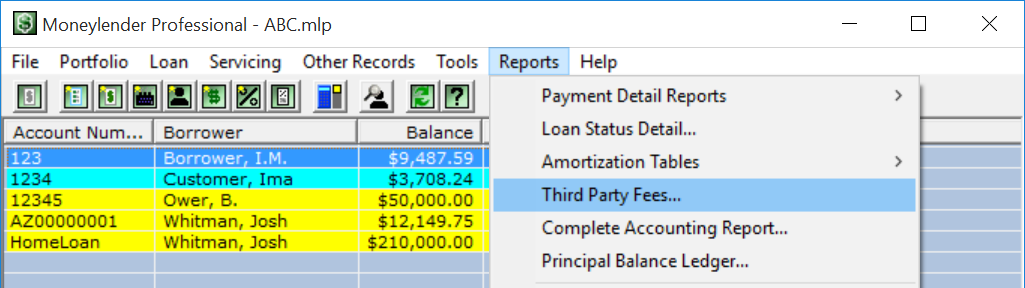

Reports Menu |

Available from the Main Menu, the Reports menu lets you print informational reports based on a single loan or on an entire portfolio. To print a report on a single loan, you must

select the loan in the list of loans first.

Available from the Main Menu, the Reports menu lets you print informational reports based on a single loan or on an entire portfolio. To print a report on a single loan, you must

select the loan in the list of loans first.The main difference between a report and a statement is that statements display only the current status of a loan, while reports generate numbers computed from a broad arrangement of records summarized and displayed in more complex ways. This distinction is the reason reports are not customizable, but statements are. Because reports read a large number of records from a portfolio — especially the entire portfolio reports — it takes some time to generate the report, especially in a network environment. Single Loan Reports contains four sub-menu items.

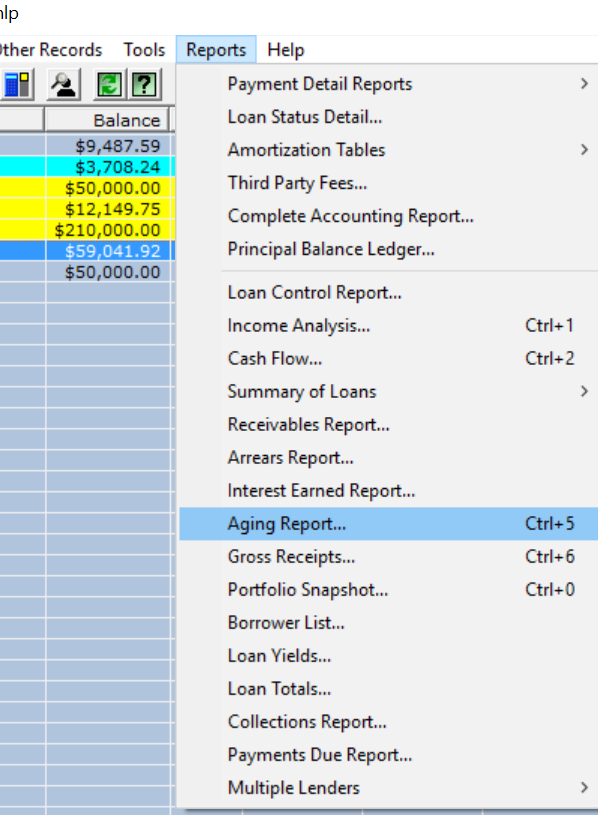

The menu contains two sub-menu items.

prints the projected amortization table from open date to maturity, assuming only the regular payment is received each month. If the regular payment or interest rate varies over the life of the loan, it is reflected in the amortization schedule. prints the same information as the Amortizaion Schedule, but, in addition, each column is totaled.

The records payments for any additional parties — other than the principals— involved in a loan. The displays payments, finance charges, credits, balance, and amounts during a specified time period. The displays debits, credits, and outstanding principal during a specified time period. Entire Portfolio Reports Displays the net portfolio balance, including breakdowns such as Paid Out, Interest, Special Charges, Payments, and Other Credits. shows the details of money received monthly over a selected date span. It also shows a breakdown of principal received and interest received. shows a monthly comparison of principal amount of new loans with payments received for a selected date span. shows how much money was received on each loan during a specific period. The report is separated by lender if there are multiple lenders in the portfolio. shows borrower names, outstanding principal, and payments due for each lending company. shows andy borrowers with payments outstanding along with the balance, fees, interest, and principal. shows total, earned, and unearned interest during a specific time period for each lending company. show amount due and balance over a select period of time.

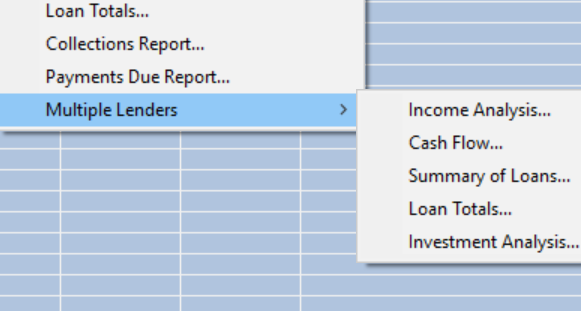

shows the payment amount and date receiveved for each account. provides an overview of all accounts within a portfolio, including important dates, balance, and amount due. shows contact and other important information for each borrower. shows average daily balance and interest for each account. shows basic information about each account, including total due, interest, and fees. shows amount due, including late fees and past due amounts. show payment amount and due date for each account. The menu contains five sub-menu items.

|