|

The Third Party Fee Record |

|

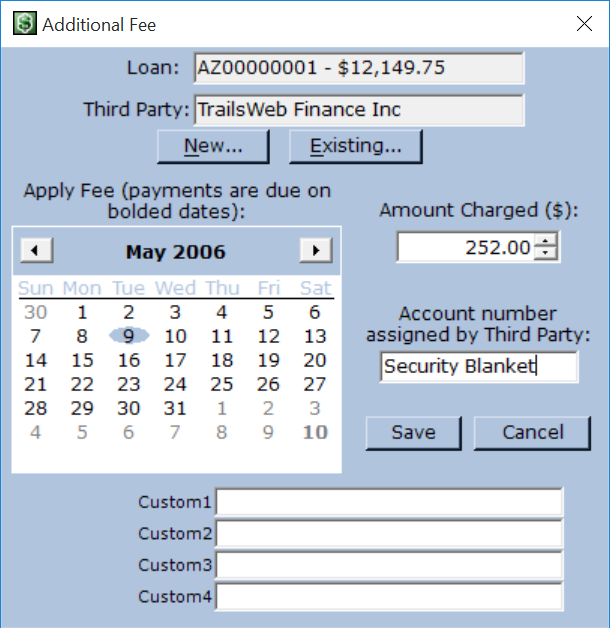

Designed to accommodate anything from NSF (non-suffificent funds) fees to property tax payments, the third party fee (also called "other fees") applies an amount to your

loan that remains separate from other amounts. Paid before late fees, principal, or interest, it is linked to a Third Party record

that contains business contact information. There are two ways to create third party fees on an account: create a single fee or pro-rate a fee across multiple payments.  To create a single fee:

To create a single fee:

To track an account number with the fee, enter the Account Number in the corresponding field. Additional information specific to this fee, such as an NSF transaction number, can be saved in the custom fields for future reference. Change the labels of custom fields from the Custom Fields tab of the Portfolio Settings dialog. All fees are handled separately from the principal/interest computation and loan balance. To add interest-bearing principal to a loan, enter a negative payment as described in the help topic The Payment Record.  To create a sequence of pro-rated fees, click from the Loan menu.

Using the New or Existing keys, create or select the Third Party to associate with the fees. Enter the Total Amount to pro-rate.

Select Prorated over X payments, and set the number of payments. For example, entering 6 on a monthly payment loan applies the Total Amount evenly over

six months.

To create a sequence of pro-rated fees, click from the Loan menu.

Using the New or Existing keys, create or select the Third Party to associate with the fees. Enter the Total Amount to pro-rate.

Select Prorated over X payments, and set the number of payments. For example, entering 6 on a monthly payment loan applies the Total Amount evenly over

six months. Select the appropriate start date for the fees. If you choose a date that would cause fees to apply after the loan's maturation date, you will be asked to change your selection. By default, Moneylender selects the next future payment due date. Thus, selecting the default date applies the fees to the next six monthly payments. If there is an account number associated with these fees, enter it in the Account Number field. Click to create the pro rated records. When managing fees on a loan, fees created with the prorated fee wizard display a (1/X), (2/X) indicator to show that it is part of a sequence. To view, edit and delete fees applied to a loan, first select the loan in the list of loans and click from the Loan menu. This opens the Manage Associated Fees dialog, displaying all fees applied to the selected loan.  To edit or delete a fee, select it in the list then click the corresponding button.

To edit or delete a fee, select it in the list then click the corresponding button. |